February 2, 2017

While U.S. grocery shoppers continue to seek tasty, nutritious food, the impact of food labels appears to be waning. What’s perhaps most telling is the differentiation that exists across generation groups in terms of the type of information shoppers of various ages seek from primary package labels. According to Mintel’s 2016 U.S. Food Packaging Trends report, purchasing inspiration based on on-pack claims can range from those touting functional ingredients to functional packaging.

Perhaps most worrisome, however, is less than half of U.S. consumers “usually read” the information on product labels, and the percentage of consumers who indicate doing so has declined over the past several years. Mintel’s custom consumer research finds that the influence of food labels is inversely correlated with age, with younger grocery shoppers less likely than older shoppers to say labels factor into their purchase decision. Such response is an indication that labels are not resonating with shopper needs and may be in need of an overhaul.

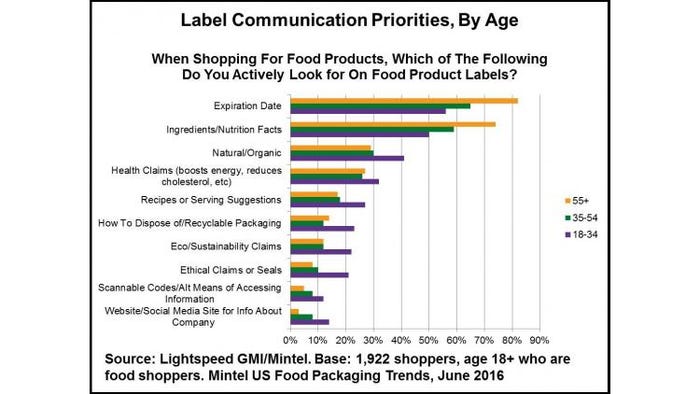

More than two thirds of food shoppers look for the expiration date on food packaging, placing it just slightly ahead of ingredients or nutrition facts and substantially ahead of most other communication items. Older adults are especially likely to focus on these few pieces of practical information.

Adults aged 18-34, however, are likely to look to packaging for a wider array of information and descriptors, including natural or organic, environmental sustainability claims, and ethical claims or seals. However, marketers must balance the temptation to add more information, claims and certifications to the package with the need to keep packaging communication simple, clean and visually impactful. iGen/Millennials are significantly more likely than older shoppers to say labels are cluttered by too many on-pack claims. While the clean label movement is nothing new, room for further improvement in on-pack communication exists.

Part and parcel of creating that impact is found among the 70% of grocery shoppers who look for ingredients listed on food packaging. Such a high percentage is a clear indication that making ingredient information easy to find should be prioritized within both the marketing and on-pack messaging hierarchy. Younger shoppers are much less likely than older ones to rely on ingredients lists. Instead, they seek the assurance of product descriptors, such as “natural” and “organic.” Natural claim positioning is of interest to those who seek high-quality products, as well as to those who are interested in food safety.

More than half of grocery shoppers say nutritional panels are informative and a third says they influence purchase. This is a strong indication of the power of this labeling element. However, only 25% of grocery shoppers think nutritional panels are easy to understand. This is where Mintel’s Global Packaging Team believes such mobile-enable packaging tools as SmartLabel will be a boon to brands seeking to convey greater transparency and consumers demanding the same.

Demographic differences

As mentioned, differentiation exists across generations. Freshness as a claim holds particular appeal among Baby Boomers, while young adult shoppers prioritize low price over nutrition. Two thirds of grocery shoppers who prioritize low price look for the expiration date on food items, and 55% of this group looks for specific brands. Such factors appear as cost savers for those who are conservative about food spend, assuring themselves that reliable products will not spoil before they are used.

On-pack claims regarding ingredient origin may attract the attention of Hispanic shoppers who are significantly more likely than non-Hispanics to say food safety and food from a local source are important in their purchase decision. Weight loss also appears as a purchase driver among this group. Mintel’s Hispanics and Healthcare report finds 55% of Hispanics consider themselves to be overweight. On-pack claims promoting how products can fit into a healthful diet on-pack may be one means of standing apart from the competition in food aisles.

Seals/certifications from organizations lead for trustworthiness. Mintel’s Trend, The Decline of Deference, discusses that distrust of business and other institutions has soared to all-time high levels, creating fertile ground for creative disruption. Seals that appear to vouch for a product from an outside source, rather than requiring shoppers to take the manufacturer’s word for it, can be considered.

A quarter of the oldest shoppers measured say claims touting brand/product history on-pack is unnecessary. In contrast, iGen/Millennials are more likely than other generation groups to say this information is important, influential and trustworthy. Millennials never forget they are being sold to, and they are willing to set cynicism aside when companies are sincere with on-pack claims. Brands that resonate with Millennials are often those that incorporate values into their corporate identity. Such response is an indication that story may play a larger role in food sales moving forward.

David Luttenberger is the global packaging director at Mintel. He has 24 years’ packaging experience and can be reached at [email protected]. You can also follow him on Twitter at @packaginggeek.

Photo credit: Designed by Bob Smith, freepik.com

**********************************************************************************************

Learn about the latest developments in food labeling and packaging design at WestPack 2017 (Feb. 7-9; Anaheim, CA).

About the Author(s)

You May Also Like