January 29, 2014

U.S. shipments of packaging machinery increased by 2.2 percent in 2000 to a value of $4.952 billion, according to the seventh annual Shipments & Outlook Study from the Packaging Machinery Manufacturers Institute. Almost all of the growth was generated by domestic market shipments, which rose 3.1 percent to $4.113 billion. Over the past five years, most growth has derived from the domestic market, reflecting the benefits of a sustained strength in the U.S. economy and a high rate of capital investment by U.S. industry. The decrease in packaging machinery exports has been linked to weakening overseas markets and the competitive disadvantage exerted by the strong dollar. Exports have been steadily declining, accounting for 17.1 percent of machinery shipments in 2000, or $849 million, down from 22.4 percent in '96.

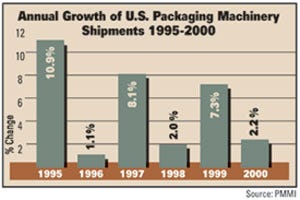

Looking at machinery shipments over the past six years, an interesting short-cycle pattern becomes apparent (see bar chart). The odd-numbered years have witnessed much higher growth, but the differences between the highest and lowest are evening out to some extent.

The Shipments & Outlook Study defines shipments only for new machinery, excluding used and rebuilt equipment, services and replacement parts.

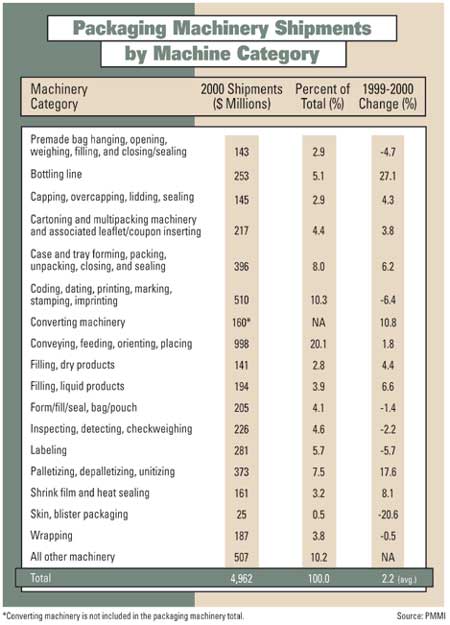

The range of growth by 17 individual machinery categories is shown in the accompanying table. The largest single category–conveying/feeding/orienting equipment–logged $998 million in shipments but registered only 1.8 percent growth over 1999. Showing the greatest growth are bottling line machinery at 27.1 percent, palletizing/depalletizing at 17.6 percent and converting machinery (primarily bagmaking and thermoforming) at 10.8 percent. The smallest category–skin and blister packaging machinery at $25 million in shipments–accounted for the most significant decrease, at -20.6 percent.

The range of growth by 17 individual machinery categories is shown in the accompanying table. The largest single category–conveying/feeding/orienting equipment–logged $998 million in shipments but registered only 1.8 percent growth over 1999. Showing the greatest growth are bottling line machinery at 27.1 percent, palletizing/depalletizing at 17.6 percent and converting machinery (primarily bagmaking and thermoforming) at 10.8 percent. The smallest category–skin and blister packaging machinery at $25 million in shipments–accounted for the most significant decrease, at -20.6 percent.

The pie chart shows the distribution of packaging machinery shipments by market segment. Food, beverage and pharmaceutical markets account for about two-thirds of machinery investment (based on dollar amounts). The remaining one-third is comprised of six market segments, none of which is larger than 7 percent.

Seven growth factors

The report notes that several overriding factors and developments, both positive and negative, impacted shipment results in 2000.

?The mixed performance of the U.S. economy. The strength of the economy during the first half of 2000 encouraged customers to continue expanding product and packaging capacity in order to handle new product introductions and increase output. However, the weakening fundamentals in the second half of last year placed a damper on capital spending as customers' concerns about lower profits, excess capacity and market uncertainty caused an abrupt tightening of budgets. ?The soft export market. As mentioned earlier, the weakness of foreign economies, coupled with the strength of the U.S. dollar, caused machinery exports to decrease yet again.

?The strength of niche markets. Irrespective of the economy's mixed impact on capital spending, machinery shipment growth benefited from the strength of certain niche sectors. In the forefront of new product introduction activity were bottled water, juice drinks, beer, energy drinks, iced tea and bottled coffee drinks.

?The sustained focus on increasing packaging productivity with higher-tech machinery. In order to increase productivity, companies continue to replace older machinery with new models. According to the PMMI Packaging Productivity Trends Indicator (see PD, October '01, p. 62), U.S. manufacturers increased packaging labor productivity by 7.8 percent, due largely to the installation of new packaging machinery.

?The continued emergence and adoption of new and alternative packaging materials, sizes, configurations and concepts. Prominent examples include the shift toward plastic bottles, standup pouches and sleeve labels, among many other packaging changes.

?The dampening effects of further industry consolidation. The pattern of industry consolidations, especially among food companies, can cause project delays and cancellations, even plant closings, which obviously impacts packaging machinery investments.

?Increased demand for used/rebuilt machinery and retrofit kits. As a reflection of tighter budgets, some customers opted for used or rebuilt machinery as a lower-cost alternative to new equipment. Sales of retrofit kits, designed to bring older machines up to current technology, increased sharply in 2000.

The Shipments & Outlook Study also includes a forecast for 2002. Packaging Digest will report on that part of the study next month.

For a copy of the complete study, which is available for $2,500, call PMMI at 1-888-ASK-PMMI.

About the Author(s)

You May Also Like