February 1, 2014

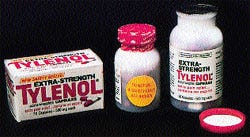

Tylenol murders spark tamper-evidence

The Tylenol tragedy in 1982, in which seven people died after ingesting cyanide-laced Tylenol® capsules, marked one of the most consequential packaging-related events of the latter half of the 20th Century. A dreadful human tragedy, the acetaminophen poisonings in the Chicago area in September of that year resulted in extensive product recalls, copycat crimes and new federal regulations for safe packaging. Interestingly, the use of tamper-resistant packaging–now termed tamper-evident (TE)–reaches back nearly 120 years, when the first U.S. patent was issued for a child-resistant (CR)/TE package, but the only laws existing in 1982 for drug security related to CR features for household products and medications.

Immediately following the deadly Tylenol tampering incident, the Federal Drug Administration passed a rule (21 CFR 211.132) requiring  the use of TE packaging on all over-the-counter drugs and some cosmetics. The agency defined such packaging as "having an indicator or barrier to entry which, if breached or missing, can reasonably be expected to provide visible evidence to consumers that tampering has occurred." Eleven suggested and approved methods were listed (updated in 1988) from which the packager could choose: film wrap; blister and strip packages; bubble packs; shrink seals and bands; foil, paper or plastic pouch (must be torn to open); bottle seal–inner-seal type; breakaway cap; tape seal on flap or cap; sealed tubes; sealed cartons; and aerosol containers.

the use of TE packaging on all over-the-counter drugs and some cosmetics. The agency defined such packaging as "having an indicator or barrier to entry which, if breached or missing, can reasonably be expected to provide visible evidence to consumers that tampering has occurred." Eleven suggested and approved methods were listed (updated in 1988) from which the packager could choose: film wrap; blister and strip packages; bubble packs; shrink seals and bands; foil, paper or plastic pouch (must be torn to open); bottle seal–inner-seal type; breakaway cap; tape seal on flap or cap; sealed tubes; sealed cartons; and aerosol containers.

Aiding packagers in their race to become compliant, PD carried many articles focusing on TE technology, and marked all TE-related product items with a special logo, through 1984.

Modern polyester sealing

In July, 1955, Modern Packaging decried that "Polyester Film is Here." They stated that the new super-strength material offered immediate packaging applications, including overwrapping and bundling of cartons. The far-superior durability and clarity of polyester material moved cellophane out of the market picture quickly, even though the prices of polyester (Mylar) were quite high at the time. But, the mass adoption of the material drove prices down quickly.

However, one problem with polyester was sealing the material. Along with static energy causing problems with packaging machinery, polyester was too stiff to seal or "weld" together at the advent of the process. Then along came benzyl alcohol, which, in conjunction with heat, "softened" the film and allowed for proper heat sealing. For high-speed machines using this process, film temperatures above 400 deg F were needed for proper sealing. In 1956, the Food and Drug Administration approved the data submitted for the benzyl-alcohol-sealing method and allowed it for food and drug packages. With the approval, this introduced the "modern age of packaging," as Robert Kelsey stated in a PD "Look Back" feature in November, 1999.

was too stiff to seal or "weld" together at the advent of the process. Then along came benzyl alcohol, which, in conjunction with heat, "softened" the film and allowed for proper heat sealing. For high-speed machines using this process, film temperatures above 400 deg F were needed for proper sealing. In 1956, the Food and Drug Administration approved the data submitted for the benzyl-alcohol-sealing method and allowed it for food and drug packages. With the approval, this introduced the "modern age of packaging," as Robert Kelsey stated in a PD "Look Back" feature in November, 1999.

Barriers boost shelf life, sales

Ever since Alexander Parkes first unveiled his Parkesine material at the 1862 Great International Exhibition in London, the world of plastics has grown and evolved. According to the American Plastics Council, celluloid followed Parkesine in 1866 when John Wesley Hyatt came up with it as an alternative to ivory for use in billiard balls. Hyatt discovered the material after spilling a bottle of collodion in his workshop, finding that celluloid resulted once the collodion congealed. It required the addition of camphor, a derivative of the laurel tree, to become the first thermoplastic. Bakelite came along in 1907, when Leo Baekeland used his "Bakelizer" to control the reaction of volatile chemicals at different levels of heat and pressure. Bakelite would not burn, boil, melt or dissolve in common acids or solvents, setting it apart from its predecessors, and it went on to be heavily used in weapons during World War II.

Rayon soon followed, as did cellophane, which proved to be the first flexible, waterproof material that could be used for wrapping. The 1920s brought polyvinyl chloride and polyvinylidene chloride, or Saran. Teflon was also discovered. Then, says the American Plastics Council, in 1933, E.W. Fawcett and R.O. Gibson, two organic chemists working for Imperial Chemical Industries Research Laboratory, discovered polyethylene. The substance has become the largest-volume plastic in the world, with major applications in beverage packaging, among others.

Other innovations, such as Velcro® and Silly Putty, followed, as did several production processes, as manufacturers began to seek more efficient ways of enhancing and extending shelf life. Laminations were used to create multilayer structures that were designed to provide barriers, preventing product from becoming stale and contaminants from outside permeating the product. According to a 1996 study on barrier plastics conducted by Business Communications Co., Inc., additional substances, such as ethylene vinyl alcohol added to the growth of barrier packaging, as did the developing coextrusion technologies in the 1970s and 1980s. Coextrusion, the study says, enabled multilayer structures in a wide range of thicknesses. This made barrier packaging much more efficient and economical.

Plastic's uses in packaging continue to grow, as manufacturers seek new materials and processes to extend the shelf lives of their products while making them more marketable.

Zippers catch on

Invented in 1954 and initially used for zippered pencil bags, the zipper closure didn't really have an impact on packaging until the last decade. Before then, its main application was the Ziploc® bag, first offered to consumers in 1968 through a licensing agreement between Dow Chemical and Minigrip, according to Zip-Pak's  website. But in 1986, Zip-Pak introduced a preapplied-zipper rollstock suitable for use on retrofitted form/fill/seal equipment. In the years that followed, innovations increased the zipper closure's capabilities, as well as its applications. One of these was the ability to seal at lower temperatures, resulting in increases in output. Later, biodegradable zippers and the Slider™ zipper for use on premade pouch equipment were developed. The retortable zipper is the next big thing in the zipper closure arena.

website. But in 1986, Zip-Pak introduced a preapplied-zipper rollstock suitable for use on retrofitted form/fill/seal equipment. In the years that followed, innovations increased the zipper closure's capabilities, as well as its applications. One of these was the ability to seal at lower temperatures, resulting in increases in output. Later, biodegradable zippers and the Slider™ zipper for use on premade pouch equipment were developed. The retortable zipper is the next big thing in the zipper closure arena.

The 1990's lettuce wrap

Back in the early 1990s, precut, bagged lettuce was targeted for the foodservice market. But a funny thing happened on the way to the market: Breathable films and their high oxygen transmission rates jumped into retail grocery stores and enjoyed an 80- to 90-percent  annual growth rate for a time during the mid-1990s. Custom resin structures, such as Dow Chemical's Affinity™ polyolefin polymer (POP) and Phillips Chemical's K-Resin® replaced EVOH, provided high OTRs for clear lettuce bags and offered an economical price break to packagers.

annual growth rate for a time during the mid-1990s. Custom resin structures, such as Dow Chemical's Affinity™ polyolefin polymer (POP) and Phillips Chemical's K-Resin® replaced EVOH, provided high OTRs for clear lettuce bags and offered an economical price break to packagers.

Also, greater knowledge about cut vegetables led to advancements in packaging. David Kuhlmann of Kuhlmann Packaging, Inc., mentioned in a 1998 PD article that "the fresh-cut vegetable industry has spent the last 10 to 15 years figuring out what's going on inside a package and what the package needs to do." With the new resins, a 1-lb, clear bag offered 17 days of shelf life from the pack date as opposed to a shelf life of less than a week without breathable film.

Puttin' on the glitz: holographics, metallized polyester

While holography today adorns all sorts of items and is often used for security applications such as counterfeiting protection, authentication of credit or transaction cards and the like, it has been associated with packaging, promotional and design applications for at least two decades. Holography dates to the late 1940s, when a British/Hungarian scientist developed the theory of holography while improving the resolution of an electron microscope. Development on the theory was limited because light sources available at the time were monochromatic, or one-color. In the 1960s, however, that began to change with the invention of the laser. Holography, it was soon found, could be used as a 3D visual medium when scientists decided to duplicate laser transmission of 3D objects. Holography became quite popular for packaging and pressure-sensitive container labels in the 1980s, used on everything from toothpaste cartons and skincare bottles to gum wrappers. Glittering, 3D prism-like designs, diffraction patterns, rainbow colors and embossing techniques for gift wrap, wine labels, cosmetics and more became popular in the early to mid-1980s, and now, a holographic film layer can become part of an induction seal on the mouth of a rigid container. In 1998, Polaroid's Mirage hologram-encoded images brought a most unusual, 3D aspect to holographics for packaging. The rainbow color-changing images that Polaroid itself used on paperboard cartons for its Onyx camera line were featured in the pages of PD's April, 1988 issue, about the same time as Prozacw and digital cellular phones were invented. Polaroid's exciting Mirage photopolymer technology involved a proprietary encoding process of laser-recorded images on special, patented photopolymer film laminated to vacuum-metallized polyester and topped with plies of Mylar and Aclar. The technology afforded well-defined, extremely sharp diorama-like images.

Back in the late 1960s, as metallizers began coating and laminating to add value to products, vacuum metallizers of packaging materials were rare. Target markets at the time for metallized materials were holiday garland, wall coverings, automotive moldings and tinsel, to name a few. A 60-in. vacuum metallizer was considered wide, and metallized films sold for approximately $1.25 a pound over the cost of the base substrate. Metallized packaging started to barely shimmer in the mid-1970s, and AIMCAL, the Assn. of Industrial Metallizers, Coaters and Laminators, emerged from the Vacuum Metallizers Assn. as a nonprofit corporation in 1970. Winners in AIMCAL's annual contests today still prove that metallized polyester and metallized oriented polyester are as popular now as when they were first introduced for packaging applications. In fact, AIMCAL says it has nearly doubled in size during the past five years, so the market for metallized materials is indeed growing. Eye-catching laminates made with vacuum-deposited metallics can make a silk purse out of a wide range of "common" and practical substrates for everything from snack foods to coffee pouches to fishing line, while providing needed barriers and functionality. Metallized films began to not only add sparkle to lackluster product sales, but they were also found to strengthen barriers to oxygen, moisture and light in order to prolong shelf life in certain foods, including potato chips and candy.

FDA approves H2O2 and heat for aseptic filling

In January, 1981, FDA made a decision that triggered a revolution in liquid packaging. In response to a petition from Tetra Pak, it approved the use of hydrogen peroxide and heat to sterilize certain packaging materials. Within months, some of  the largest food companies in the U.S., including Ocean Spray, Coca-Cola, Borden and General Foods, were introducing juice and other drinks in multilayer aseptic cartons. The initial packages were 200- or 250-mL rectangular cartons with straws attached to the outside. But from those simple beginnings, the package has expanded into a wide array of different sizes and shapes.

the largest food companies in the U.S., including Ocean Spray, Coca-Cola, Borden and General Foods, were introducing juice and other drinks in multilayer aseptic cartons. The initial packages were 200- or 250-mL rectangular cartons with straws attached to the outside. But from those simple beginnings, the package has expanded into a wide array of different sizes and shapes.

Actually, the technology was nearly 20 years old by the time of FDA's approval. The Tetra Brik package was introduced in Sweden in 1963, and the first installation in North America was at Laiterie Cit., Canada, in 1974. Two U.S. companies, Real Fresh, Visalia, CA, and Valley Fresh, Sumner, WA, had machines running shelf-stable milk for export prior to FDA approval, but that approval opened the door to sales in the U.S., and the boom began.

Milk goes designer

It started in 1995, when Mayfield Dairy Farms, Inc., a member of the Dean Foods family located in Athens, TN, dumped gabletop cartons for its quart, pint and half-pint sizes of milk. Mayfield, embracing the emerging trends toward retro designs,  replaced the gabletops with plastic bottles that mirrored the shape of the glass milk bottles of old. The bottles were blow-molded of natural high-density PE and enveloped in heat-shrinkable sleeve labels. Two years later, the parent company followed suit, and the Chug™ was born. Variations of the Chug are widespread nowadays, with applications expanding to products such as half-and-half and flavored, nondairy creamers.

replaced the gabletops with plastic bottles that mirrored the shape of the glass milk bottles of old. The bottles were blow-molded of natural high-density PE and enveloped in heat-shrinkable sleeve labels. Two years later, the parent company followed suit, and the Chug™ was born. Variations of the Chug are widespread nowadays, with applications expanding to products such as half-and-half and flavored, nondairy creamers.

Shrink-sleeve labeling

Shrink-sleeve labeling

A technology imported to the U.S. from Japan in the 1980s, shrink labeling was used for many years to apply clear or printed TE seals over caps, as well as to join together single-unit items in quantities of two or more, with a promotional shrinkband. But, the dawn of the new millennium opened up a colorful chapter in shrink-labeling history.

In the fall of 1997, when Dean Foods introduced the Chug line of bottled milk, the  wildly popular beverage sparked a veritable full-body shrink-sleeve-label frenzy. Packaged in HDPE bottles with fluted caps, the four-variety milk line used brightly flexo-printed full-body PVC sleeve labels that propelled it right out of the milk case and into consumers' shopping carts. Following the Chug launch, milk, water and juice products followed suit packaging-wise, each one out-designing the next with uniquely molded, contoured bottles with snugly fitted and beautifully printed film-sleeve labels. Other product categories soon followed, including powdered mixes, sauces, dressings, candy, snack foods, oils and lubricants, and more, in both plastic and glass bottles. By September, 2002, nearly the entire News Perspective column of PD was devoted to news of emerging shrink-sleeved packages. In May, 2003, a PD feature article headline claimed "Sleeve labels sprouting faster than May flowers."

wildly popular beverage sparked a veritable full-body shrink-sleeve-label frenzy. Packaged in HDPE bottles with fluted caps, the four-variety milk line used brightly flexo-printed full-body PVC sleeve labels that propelled it right out of the milk case and into consumers' shopping carts. Following the Chug launch, milk, water and juice products followed suit packaging-wise, each one out-designing the next with uniquely molded, contoured bottles with snugly fitted and beautifully printed film-sleeve labels. Other product categories soon followed, including powdered mixes, sauces, dressings, candy, snack foods, oils and lubricants, and more, in both plastic and glass bottles. By September, 2002, nearly the entire News Perspective column of PD was devoted to news of emerging shrink-sleeved packages. In May, 2003, a PD feature article headline claimed "Sleeve labels sprouting faster than May flowers."

According to several sources, from the mid-1990s onward, the shrink-sleeve label began growing at an annual rate of 15 percent. In 2001, Packaging Strategies made available a report on the market that stated: "Shrink labels for contour packaging will be the fastest-growing segment in the North American label industry through 2005–with a projected annual growth rate of more than 20 percent."

The accelerated use by packagers of shrink-sleeve labels pushed both resin and film manufacturers, and bottle molders to enhance their offerings. For maximum shrink around complex contoured bottles, PVC manufacturers have engineered film that can shrink up to 65 percent. PVC, however, is less environmentally friendly than polyethylene terephthalate glycol and oriented polypropylene alternatives. PETG has similar shrink properties and a higher degree of recyclability, but is more expensive than PVC or OPP. The least-expensive and the most environmentally friendly option is OPP, but it offers just upwards of 25-percent shrinkage capability.

According to the Packaging Strategies report, PETG is expected to grow at the highest rate, 35.4 percent, through 2005, with PVC at 12.4 percent, coming in second, and OPP at 8.3 percent. The report adds that oriented polystyrene will grow by 10 percent.

Wide-mouth plastic bottles hot for fill

Capable of being filled at temperatures up to 198 deg F, TreeTop, Inc.'s 48-oz bottle was the first hot-filled PET food jar for applesauce, PD reported in March, 1998. The injection-stretch/blown jar featured a monolayer, wide-mouth design with a  layered, pentagon-shaped shoulder that bolstered the jar to resist ovalization after cooling and top-load crushing. Knouse Foods quickly followed TreeTop's lead, introducing PET jars for its brands of Musselmans, Lucky Leaf and Apple Time brands of applesauces. Other design quirks included built-in pinch grips that not only facilitated consumer pouring, but also allowed the jars to withstand the vacuum pull as the hot applesauce cooled after filling. Their lightweight characteristics, coupled with the elimination of broken jars, has led to PET being used widely for hot-fill applications.

layered, pentagon-shaped shoulder that bolstered the jar to resist ovalization after cooling and top-load crushing. Knouse Foods quickly followed TreeTop's lead, introducing PET jars for its brands of Musselmans, Lucky Leaf and Apple Time brands of applesauces. Other design quirks included built-in pinch grips that not only facilitated consumer pouring, but also allowed the jars to withstand the vacuum pull as the hot applesauce cooled after filling. Their lightweight characteristics, coupled with the elimination of broken jars, has led to PET being used widely for hot-fill applications.

Recycling and resin

In the late 1980s, waste issues and source reduction propelled recycling to the packaging forefront. In 1988, the Society of the Plastics Industry developed the Resin Identification Code that offered a consistent national system to facilitate recycling of postconsumer plastics. A growing number of communities at the time began to implement recycling programs, and the code was developed to provide manufacturers with a consistent, uniform system that could be applied nationwide. Specifically, the coding system offered a way of identifying the resin content of bottles and containers commonly found in the residential waste stream.

The SPI code identified six major resins that are used for plastic packaging: PETE; high-density PE; PVC; low-density PE; polypropylene; and polystyrene. And, a seventh category, "other," was created to address legislative demands in some states that all consumer packaging have some resin identification.

As of January 1995, 39 states adopted legislation regarding the use of resin identification codes on bottles of 16 oz or more and rigid containers of 8 oz or more.

Oxygen scavengers

Oxygen scavengers have been used commercially in Japan since 1977. In the U.S., General Foods began to ship ground roast coffee in 1984 with the Fresh Lock system, an oxygen scavenger system based on Mitsubishi of Japan's Gas Chemical  formulation. Initially, oxygen scavengers were placed in sachets, but growing reservations about the liability of these loose packets in food packages in the U.S. led to other oxygen-scavenging developments.

formulation. Initially, oxygen scavengers were placed in sachets, but growing reservations about the liability of these loose packets in food packages in the U.S. led to other oxygen-scavenging developments.

In the late 1990s, Modified Atmosphere Packaging emerged with Ready-To-Eat meals that offered extended shelf life. The emerging technology for this packaging development was an oxygen-scavenging PE film. The oxygen scavenger technology was incorporated at the polymer-formulation stage and would be present when the film layer was produced. For MAP, a thin-layer of PE film covers an oxygen-barrier plastic container that contains precooked food. The film layer reduces the residual amount of oxygen inside the food container to protect against rancidity and discoloration.

UPC, EAS, RFID and EPC

This alphabet soup represents the key to article identification and tracking. In April, 1973, the 10-digit Uniform Product Code was approved, after years of discussion–some of it heated and bitter. Bar codes were quickly implemented at the retail level, especially in supermarkets.

Not new, Electronic Article Surveillance has been available for two decades. Most people recognize EAS as the alligator tags affixed to clothing by retail stores, in an effort to deter theft. Much smaller versions of these Radio Frequency Identification tags are available for even the tiniest of packages. RFID involves a battery-operated signal device, usually a tag, and an electronic reader. RFID has been in use since the late 1940s, but it is only now at the dawn of its widespread acceptance and use, especially in the supply chain. When Wal-Mart–the world's largest retailer–told its suppliers to get on board RFID or get lost, the entire world listened.

The Electronic Product Code is the electronic answer to bar codes. Developed by the Auto ID Center at Massachusetts Institute of Technology, which closed Oct. 31, and now administered by EPCglobal, the code is an infinitely more dynamic identifier than printed bar codes. EPC does not require line-of-sight to be read, multiple codes can be read simultaneously, and the code can be updated or amended at any time. EPC will speed accurate shipping and inventory tracking, simplify product recalls, reduce theft and counterfeiting–eventually, it will even teach your refrigerator to detect food beyond its use-by date. Despite its limitless qualifications, however, EPC will not replace bar codes until the infrastructure costs of tags and readers become widely affordable.

Oil embargo, energy crisis shake economy, packaging |

"'Where has all the resin gone?' was a haunting refrain heard amidst the clamor and color of this vibrant, record-breaking tradeshow." This is a statement about the National Plastics Expo, made by current PD publisher and vp Bob Heitzman, in his first editorial column. Heitzman, who at the time had just taken the editorial helm of PD with the November, 1973, issue, was referring to the success of the just-concluded show. He went on to comment, "In my 12-year association with packaging, I've never seen a more challenging time." |

About the Author(s)

You May Also Like