While there is still plenty of room to grow, recycling of rigid PET and HDPE plastic packaging is under-appreciated and rarely recognized.

July 7, 2022

As you’re aware, there’s been a great deal of controversy lately regarding the success or failure of plastics recycling. There has also been the expected amount of industry defensiveness in response.

I’ve asked the U.S. recycling experts on the SPRING team to weigh in on the discussion. They are:

Tom Brady, PhD, Founder and Chairman Emeritus, PTI. Prior to founding PTI, Dr. Brady was Vice President of Plastics Technology for Owens-Illinois where he led the development of the first PET plastic soft-drink container and directed the technical activities for all O-I’s plastic product lines;

Myles Cohen, Pack Green Coalition Advisor, Past President of Pratt Recycling, and Past President of Sonoco Recycling;

Chaz Miller, Chaz Miller Associates, Previously Director of Policy/Advocacy at the National Waste & Recycling Association; Director, State Programs at the National Solid Waste Management Association; and Director, Recycling at the Glass Packaging Institute;

Cal Lakhan, PhD, Faculty of Environmental Studies at York University, Toronto, Canada; previously Senior Researcher, Ontario Center for Recycling Research; and well-known recycling iconoclast.

I’m proud of SPRING’s overall level of recycling experience and expertise. You might be interested to learn that it took more than a week for the group to vet all this information and agree on both key findings and conclusions.

This is because data collection in the solid waste space is like trash collection: There’s a lot of it. Much of it smells and should be thrown away.

And finally, no one wants to take responsibility for it ;-)

Listed below are the team’s key points and findings:

The United States' overall beverage container recycling rate is approximately 28%, while the 10 states with container deposit laws have a 54% average rate of beverage container recycling. These 10 states represent 27% of the U.S. population. For reference, the 10 most populous states without bottle bills represent 41% of the population and have a collective bottle recycling rate of only 13%. (Source: U.S. Census Bureau 2021 data; and SPRING data analyzed from information collected by Eunomia Research and Ball Corp. and The Recycling Partnership.)

Further, studies show that beverage container legislation has reduced total roadside litter by between 30% and 64% in the states with bottle bills. (Source: "Bottle Bills Prevent Litter", BottleBill.org.) Yet, after 30 years, there are only 10 deposit states in the US.

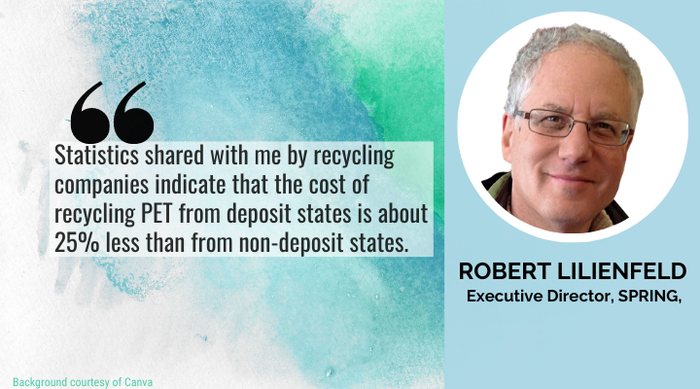

Statistics shared with me by recycling companies indicate that the cost of recycling PET from deposit states is about 25% less than from non-deposit states because the yield (after removal of contaminated materials) was 80%, compared to 60% from non-deposit states.

Markets for recycled PET and high-density polyethylene (HDPE) are relatively strong. It’s possible that, if passed, new recycled content legislation might push PET prices higher. More bottle bills will be needed almost by necessity to provide a clean and reliable supply of material, and to ensure both ongoing demand and preferable economics.

According to the EPA’s 2018 Sustainable Materials Management study (Table 25, page 43), recycling rates for bottles and jars made from PET and HDPE are higher than what consumers have been led to believe: While there is still plenty of room to grow, the recycling rate for PET is 29.1%, and the rate for HDPE natural bottles (e.g., milk jugs) is 29.3%.

PET used in bottles and jars, and natural HDPE, together account for 57% of plastic packaging recyclable volume. Yet, it is the other 43%, including bags, wraps, and other containers — made primarily from low-density polyethylene (LDPE) and polypropylene (PP) — that garners all the attention.

Based on all the above, here’s what we collectively conclude:

Don’t throw out the baby with the bathwater! Regardless of recycling issues related to LDPE, polypropylene (PP), and polystyrene (PS), rigid containers — bottles, jars, clamshells — made from PET and HDPE are not only being successfully recycled, but recycling rates are also relatively high compared to other plastics. Further, there is currently a strong business case for recycling them, as there is supportive infrastructure already in place and ready markets exist. Also, through legislation these markets are being strengthened.

We already know how to significantly increase both the tonnage and yield of rPET. New bottle bills can increase the recycling rates of rigid PET containers to virtually double the current national recycling rate, from 28% to about 54%.

Further, my own brief analysis indicates that doing so would add about three times more recycled tonnage to the PET stream. What’s more, this additional tonnage would be significantly cleaner than without bottle bills, thus increasing overall yield by about 33%!

However, we must be sensitive to the fact that bottle bills will reduce the amount of profitable aluminum can and PET bottle recycling business at municipal recovery facilities (MRFs) in non-bottle bill states.

As Chaz Miller stated to the group, “This problem can be fixed but must be addressed.”

It’s time for the plastics industry to acknowledge that all plastics are not created equal. By continuing to talk about plastics recycling, rather than rigid container recycling primarily related to HDPE and PET, organizations like the American Chemistry Council and PLASTICS do a disservice to their industry. Here’s what should be done:

Create awareness of the recycling value and efforts behind rigid containers, including PET clamshells, and push for more bottle bills.

Explore ways to separate out and purify rigid HDPE and PET streams vs. other polyolefins.

Push for socially acceptable ways to recover and reuse LDPE, PP, and PS.

Finally, the plastics industry should stop talking to itself and start addressing the American public directly and honestly. What the public wants is for the industry to acknowledge their concerns; frame solutions in terms that they understand and believe are addressing their problems; and update them constantly as to industry progress — both successes and failures.

Robert (Bob) Lilienfeld has been involved in sustainable packaging for 25 years, working as a marketing executive, consultant, strategic planner, editor, writer, and communications expert. He’s President of Robert Lilienfeld Consulting, working with materials suppliers, converters, trade associations, retailers, and brand owners. He is Executive Director at SPRING, The Sustainable Packaging Research, Information, and Networking Group. You can also write him at [email protected] or visit his LinkedIn profile.

About the Author(s)

You May Also Like