Flexible-Packaging-Breaking-News-Best-1540x800.png

Flexible Packaging

Breaking News in Flexible Packaging April 2024Breaking News in Flexible Packaging April 2024

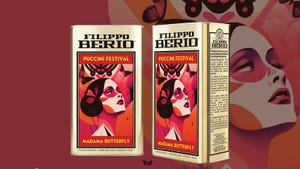

PCR crisps bags, dual-function yoghurt pouch, greener dirt bag, ProAmpac's sandwich film, innovative X-LOOP packaging, 8+ million pods recalled.

Sign up for the Packaging Digest News & Insights newsletter.

.png?width=300&auto=webp&quality=80&disable=upscale)