New Amcor: Assessing the impact of the world’s largest manufacturer of consumer packaging

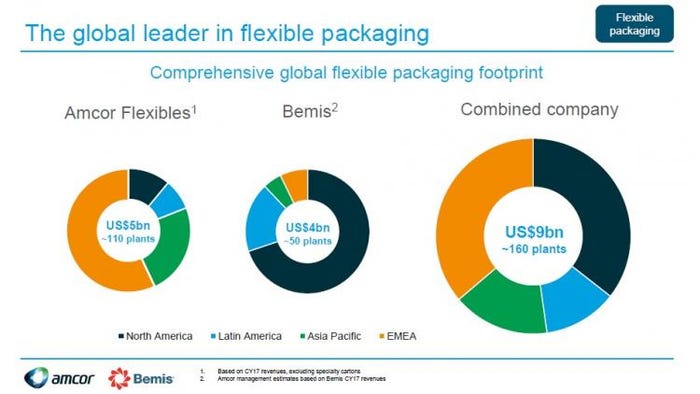

On Aug. 6, 2018, Amcor announced it was buying Bemis in an all-stock deal worth US$6.8 billion. The combined company will be a packaging powerhouse, geographically and in four segments: flexible packaging, rigid plastic packaging, specialty cartons and closures.

Shortly after the news broke, Sara Shumpert Dunn, managing director of The Packaging School and Packaging Digest Editorial Advisory Board member, posted on LinkedIn: “What effect do you think this will have on the packaging industry?”

My opinion is “I think the impact will be huge, especially for flexible packaging innovation. Both companies have great reputations and I believe the combined synergy will benefit customers all around the world.”

Brian Wagner, co-founder and principal of leading packaging consultancy PTIS, replied, “Agreed Lisa—and in a pretty fragmented industry, there had to be more consolidation.”

Over the last two decades, there has been a fair amount of consolidation happening in North America. But globally, the number of suppliers in the New Amcor’s four packaging areas—flexibles at 66%, rigid plastics at 22%, specialty cartons at 9% and closures at 3%—shows potential for further mergers and acquisitions.

The product mix itself, though, doesn’t need tweaking, according to Amcor CEO Ron Delia. He told Reuters, “We’re very happy with our portfolio as it currently sits, and this Bemis transaction just bolsters that portfolio. It’s the perfect fit for our flexible packaging footprint.”

In the flexible packaging market specifically, I believe the New Amcor will set a high bar for innovation as the talented Amcor and Bemis staffs begin to collaborate rather than compete. As a frequent judge for the Flexible Packaging Assn.’s annual Flexible Packaging Achievement Awards, I can testify to the clever and creative solutions converters develop on a consistent basis. I can’t wait to see what they create together.

And customers are sure to gain an edge from tapping into the new company’s industry leading capabilities in research and development (R&D).

Delia is focused on communicating these benefits, telling CNBC the deal is “overwhelmingly about adding capability and talent.”

According to the Reuters report, Mark Wilde, analyst at investment bank BMO Capital Markets, also sees advantage in the unified staff. “I think Amcor is getting great technical know-how,” Wilde said.

William Austen, president/CEO of Bemis, identifies three ways customers will benefit: “The combination will enable us to offer global, regional and local customers the most compelling value proposition in the industry through a broader product portfolio, increased product differentiation and enhanced operating capabilities.”

Balanced markets

Geographically, the acquisition is highly complementary between the Australian Amcor and Bemis, with its home base in America’s Midwest (Neenah, WI). Global packaging analyst Mike Richardson from The Freedonia Group explains in a press release, “While both firms have a substantial presence in flexibles, they weren’t big in the same regions. Amcor is a heavyweight in Europe and Asia, but less so in the U.S. Meanwhile, Bemis brings to the merger a much stronger position in North America.”

Bemis is also strong in Latin America, and brings in major brand-owner customers, especially in the food industry, which has, historically, accounted for 80% of the company’s sales. In the new company’s structure, food and beverage represents a majority (two thirds) of its business.

Healthcare is another key market for both branches of the New Amcor.

I wonder what advantage the New Amcor might have in global sourcing of aluminum/foil for barrier packaging for its food and healthcare markets.

Sustaining a leadership role in plastic packaging

The vast majority of the company’s business is in plastic packaging. I expect future innovations from the New Amcor will bolster the positive image of plastic packaging, helping to counter the negativity the industry is fighting from an environmental view. The problem of marine debris—highlighted by massive ocean gyres and continual outcries from environmental groups—along with bans and potential regulations on single-use plastic packaging has manufacturers, and brand owners that use plastic packaging, on the defense.

[This critical attention is why Packaging Digest is focusing on issues related to plastic packaging sustainability in its annual Sustainable Packaging Study. CLICK HERE to take the survey now so your voice will be heard.]

Amcor has aggressive sustainability goals, having pledged to develop 100% recyclable or reusable packaging products by 2025. Bemis has also been active for years in marketing the sustainable benefits of flexible packaging. In its 2017 Corporate Responsibility Report, Bemis announced, “We have made tremendous progress toward the environmental sustainability goals we set out for ourselves in 2010. We have successfully reduced waste to landfill and our use of process water, solvents, electricity, and fuel.

“Given the meaningful progress in our goals, we are now simplifying our approach and extending our progress for the long term by adopting a ‘maintain and gain’ philosophy. We aim to hold the progress (maintain) and look for opportunities to continually improve even further (gain) as we grow our business.”

Industry responds

The deal has drawn the interests of experts and players in the packaging industry—and I’m sure more analysis will follow.

In the meantime, here are a few more comments via the LinkedIn conversation mentioned above, where Dunn asks “What effect do you think this will have on the packaging industry?”

• Matt Baldock, innovator, founder and managing director, Digimock Ltd., Vow Packaging Partners Ltd.: “Very happy shareholders, very worried staff, very hesitant customers. Still, two brilliant companies—and I hope the Bemis name remains active.”

• Shumpert Dunn (who posted the LinkedIn question): “Definitely hoping it will open up more opportunities for innovation and improvements in sustainability thanks to improved supply chains.”

• Mark Moorhead, global marketing director, printing and packaging at Michelman: “Proud of my time with Bemis and the great company they are. A great and complimentary union in so many ways. Brand owners benefit from even deeper and broader global expertise. Congratulations!”

• Flexible packaging authority Dennis Calamusa, president/founder, AlliedFlex Technologies Inc.: “The strength and vision of both these groups combined should certainly benefit our industry. The challenge will be separating the core competencies of each organization to eliminate redundancy and spark more innovation. This will be critical if we as an industry are to adapt to the growing needs of the market and the consumer. All the tools and personnel are in place, but now the hard work begins of developing one team. Look forward to supporting this new Amcor-Bemis Team.”

What are your thoughts about this mega-merger? We’d love to hear them.

********************************************************************************

Packaging solutions come to Minneapolis: As part of the region’s largest advanced design and manufacturing event, MinnPack 2018—and the five related shows taking place alongside it—brings 500+ suppliers, 5,000+ peers and 60+ hours of education together under one roof. Register for free today.

About the Author(s)

You May Also Like