CPG success determined by small segment of shopping public

March 11, 2015

CPG success is determined by a small percentage of shoppers

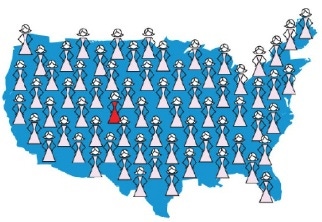

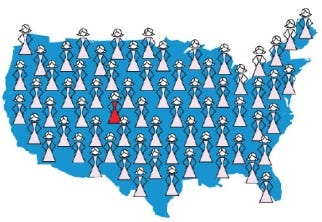

A new report published by Catalina, a consumer-driven marketing firm, finds that only a tiny fraction of shoppers determine the success of new Consumer Packaged Goods (CPG) product launches. The report explores the purchasing behavior of more than 41 million US consumers and shows that on average, just 1.5 percent, or 1 in 67 shoppers, accounted for 80 percent of volume during a 12-month window following their introduction.

The study, which examined 25 of the top product launches of 2010, also found that for line extensions, 63 percent of sales came from existing brand buyers, of which almost half of those sales cannibalized existing brand purchases. For a copy of the report, click here.

"This report shows just how few consumers make or break even the most successful new CPG product launches. Of the 25 new products studied in this report, just 1 out of 67 shoppers made up the vast majority of sales," said Todd Morris, executive vice president, brand development, for Catalina. "With such small shopper concentrations driving the success of product launches, it's critical for a brand's advertising and promotions to reach the consumers who are most likely to try and repeat."

This tiny percentage of shoppers that accounted for most sales was worth 64 percent more per capita than the average new brand trier. Even the biggest selling new products in the study depended on extremely small percentages of shoppers for sales. The two top selling products tracked in the study, an enhanced water beverage and a Greek yogurt, depended on just 1.4 percent and 2.7 percent of consumers, respectively, to drive 80 percent of their sales.

Finding the Most Likely Buyers

According to the report, high-volume category buyers and, in the case of line extensions, high-volume brand buyers are much more likely to try new products than average shoppers. Top category buyers, who accounted for 80 percent of sales in the category prior to a new product launch, were 3.8 times more likely to try than the average shopper. For product line extensions, top brand buyers, who accounted for 80 percent of brand sales prior to a new product launch, were 5.8 times more likely to try than the average shopper.

Top brand buyers were also 28 percent more likely to repeat the purchase than the average new buyer, while top category buyers were 19 percent more likely. The performance of top brand buyers, however, was tempered by cannibalization of sales of existing products within the brand. On average, existing brand buyers accounted for 63 percent of sales for the products tracked in the study. However, 27 percent of all new product sales, or 42 percent of the purchases of existing brand buyers, actually cannibalized existing brand sales.

Methodology

Utilizing privacy-protected anonymized and aggregated data, the New Product Report analyzed the two-year purchasing behavior of approximately 41 million US consumers at approximately 20,000 stores, representing a portion of the Catalina Network. All consumer purchase data came from consistent shoppers who shopped at least twice in every eight-week interval within the retail chains during all study periods. Trial, repeat, and cannibalization metrics were time-aligned to 52 weeks prior and 52 weeks following product launch in the Catalina network.

Source: Catalina

.

You May Also Like