Smart packaging helps boost Amazon’s auto-replenish service

The Amazon Dash Replenishment Service (DRS) is now able to support smart packaging and devices with embedded technology that senses when new supplies are needed, helping consumers automatically reorder product before it runs out.

“Amazon has opened up the Dash Replenishment Service to third-party providers,” says Dr. Amanda Williams, smart packaging lead at Jabil Packaging Solutions. “This is the software that lives behind the Dash button, where you just push a button and it will automatically replenish your coffee, your detergent, your diapers.”

As one of the first certified members of Amazon’s Solution Providers program, Jabil Packaging Solutions is “combining proven electronics, wireless communications, sensors and supply chain management capabilities with massive manufacturing scale to transform the packaging landscape” for ecommerce, says Christine McDermott, chief marketing officer, Jabil Digital Solutions and Jabil Packaging Solutions.

Dean Seifert, general manager, Amazon Dash, says, “We are thrilled to introduce the DRS Solution Providers program to developers and brand owners. Solution Providers like Jabil help developers leverage more complete designs, including smart packaging designs that are already pre-integrated with technologies needed for an automatic reordering experience with Dash Replenishment. This will make overall time to market even faster. Companies interested in the DRS Solution Providers program will find additional details on the Amazon Developer Services and Technology page. We can’t wait to see what developers build.”

The Dash Replenishment Service provides unprecedented consumer convenience, yes. But the brand benefits are equally impressive. According to Amazon, “By early 2017, Dash-initiated transactions jumped to four orders per minute—quadruple the previous year’s rate. And the Dash Button has shown that re-order convenience has a measurable impact on product sales as well. Brands like Peet’s Coffee and Ziploc see more than 50% of their Amazon sales via the Dash Button, and Cottonelle’s share of wallet in the bath tissue category doubled from 43% to 86% among Dash users in 2016 alone.”

With Jabil’s DRS-enabled packaging, when products are running low, the “connected” packaging containers trigger a new order from Amazon.

How does this smart packaging work? Sensors are added to the packaging, which then communicate wirelessly with Amazon’s Dash.

Williams and Jabil Packaging Solutions vp Joe Stodola explain more how the auto-replenishment technology works, along with how brands can use these smart containers to give consumers a customizable, easy product repurchase method that conveniently streamlines product replacement and fosters loyalty for the brand.

What specific technology—Bluetooth? Near-field communication (NFC)? Radio frequency identification (RFID)? Other?—are these smart containers using to communicate with Amazon to automatically place an order?

Williams: We can do a lot of different connectivity technologies, such as Bluetooth, NFC and RFID. We could do any of those. Because our parent company is an electronics manufacturing services provider (EMS), we have a lot of expertise in-house on designing wireless connectivity solutions, like radio frequency and antenna design.

We have more mature templates for some than for others. Right now, we have a technical blueprint that uses Bluetooth low energy (BLE). BLE is great if you’re sending small packets of information. You don’t want to send, like, audio over BLE. But for the kind of data we’re dealing with, it’s a really good solution. It doesn’t suck up a lot of battery.

We also have a WiFi reference design in the works that we’ll be wrapping up this summer.

And I’ve done a bit of work with demos with NFC.

Those are the three communication technologies we’ve identified as being the most important.

What types of packaging can be embedded with this smart auto-replenish technology—that is, with sensors?

Williams: Virtually any type of packaging.

Right now, our focus is on device-plus-consumables systems. Think of Plug-ins for air freshener, soap dispensers, spice rack, bulk-feed dispensers, hand sanitizers—that kind of thing. Or for detergent cartridges for your washer or blood vials that go into a centrifuge.

From a cost perspective, the device-plus-consumables combination is what is most useful right now.

You can connect consumables right now with NFC tags.

We are always planning for the next step and we think the connected consumable is the Holy Grail—and we’re working towards that. We benefit a lot from our parent company Jabil because we have resources available to do things, like trials of printed electronic solutions, for example.

Printed electronics promises to bring down costs a lot because you can use a roll-to-roll printing process—it’s a lot faster and cheaper than the current process for making flexible electronics right now. We’re very close to printed electronics becoming mainstream. The main things needed for that are a good integrator and customer demand.

What types of products can use this technology?

Williams: We’ve expanded our portfolio of contents beyond liquids. We are also working on bulk solids, and on sheets (like baby wipes). We have a demo that’s NFC-tag based—for example, a number of different bottled products in a rack or shelf. This makes a lot of sense for the shelf in your shower or spice racks in your kitchen.

There are a bunch of different ways to check product usage. And different solutions make sense for different types of products.

How much does this auto-replenish technology add to the cost of packaging?

Williams: That depends on how you implement it. If we’re talking about NFC tags, right now that would add maybe 15 cents. For expensive beauty products or high-end spirits, that makes sense. It doesn’t make a ton of sense on a $2 product.

If you did a device-plus-consumable model, then, on the consumable, we would be talking about the difference between a low-end label versus a nice label. It’s not a huge difference. One of our reference designs just augments the label with conductive inks for the sensing solution.

The cost would be negligible then, right?

Williams: Yes. There’s a minimal cost associated with the consumable costs, as well as a few dollars usually associated with the cost of the durable.

How do DRS-integrated packages sense product usage?

Williams: It depends a lot on the product.

For liquid level, we use capacitive sensing. That’s where the label and conductive ink really helps because it’s fitted perfectly to the consumable, so you can get really accurate sensing.

For other products, like for bulk solids and sheets, we’ve been getting a lot of mileage out of proximity sensors. It depends on where you place them and what you’re trying to detect.

We’ve also been looking at just being able to tap NFC tags. That requires a little user interaction but it’s super quick and easy.

Bottom line: We make custom solutions for our customers. We have strong design and development teams. If someone needs a sensor solution, we have someone to figure it out. There are problems we’ve already put effort into solving, but if a customer came at us with something totally new, we have the resources for custom development solutions.

Can consumers set the product level that triggers the new Amazon order? If so, how?

Williams: Yes. It’s super easy. For the certification we’ve done with Amazon, we’ve developed an auto-replenishment system app. The app can be branded according to our customer.

Setting the level for auto replenishment is a simple setting in the app. You’ve got a picture of the product and you just drag a level-set around.

How can consumers modify their orders—to change flavors, for example—before the order is transmitted?

Williams: With the Dash button, you can change the product order in the Amazon app. We’ve worked with the DRS team pretty closely to link our app to a lot of Amazon’s capabilities. Our app would be linked to your Amazon account and can provide an easy interface to product selection.

After you place the order, you can cancel or postpone it. The user gets a lot of control—when they want it. Or, if you want these processes to just work in the background so you don’t need to think about it, you can do that, too.

What benefit does this smart auto-replenish packaging bring to consumers?

Williams: It brings a pretty big benefit. There’s a term I keep using: cognitive overhead. That means you are keeping track of your stuff, your inventory in your home. You notice when you need more. You put it on a list. You plan your shopping trips and store visits. For one product, it’s a minor nuisance. For your whole household, it’s a lot of background, invisible mental labor. And sometimes you make mistakes because you’ve got a lot going on. Then suddenly you’re out of coffee—and it’s a tragedy.

It would be really nice to have that stuff take care of itself, reliably. And then you can free up all these cycles to think about stuff you’re actually more interested in.

That’s the vision, the future we want to work towards, where replenish systems are routine. I imagine that world is one where you’re freeing up a lot of that background cognitive effort you don’t really want to be doing but you have to.

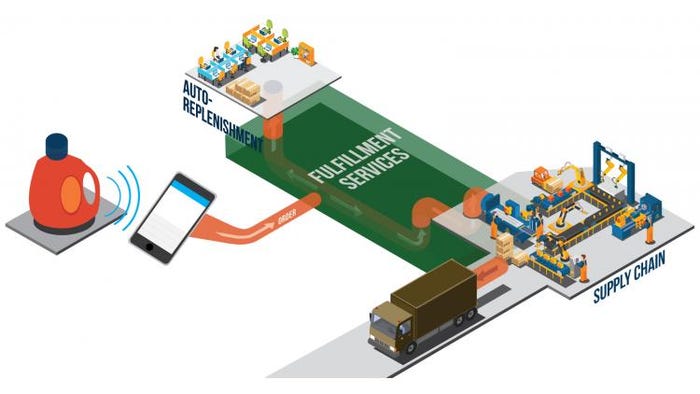

Stodola: Amazon DRS and all of the capabilities Amanda is developing for connecting consumables’ packaging to a device is following the trend of direct-to-consumer. Today, you can link a Dash button with a product you want to buy and, immediately, it’s fulfilled. When you think about what we’re designing here, it’s like putting a Dash button on the package.

The consumer’s benefit is really for those things in their life they want to not think about—stocking and supplying. As a consumer, you can choose what parts of your life you want to put on auto pilot and reduce that cognitive overhead.

In the professional arena, the business format, think about the amount of manpower that goes into keeping track of inventory, and having products supplied when you need it, on demand, just in time. All of those things are managed now by having an interaction between a consumable and a device. Or you simply move that knowledge point about what’s being consumed to the actual package.

It could be coffee, or dog food. It could be syrup for a restaurant’s drink dispensers. It could be the amount of imaging material hospitals have for their MRI machine. All these things can be hooked up to auto replenishment if the package had the ability to connect to the network and give you more ability to transact to your business or your life.

So, it could benefit a lot of different types of products at various points in the supply chain, including business-to-business (B2B) and healthcare. That’s good to know.

In your press release, you say, “The ability to better understand consumer habits and preferences—not just in purchasing, but in actual use—will prove invaluable in driving deeper customer insights and informed product innovations.” How can brands leverage the consumer usage data generated by these smart containers?

Stodola: That’s one of the key benefits. Amazon is in position to help brands move their products to their consumers. All the data sits on the Amazon side. This now allows the brand to capture that data.

Williams: It doesn’t deprive Amazon of data in any way—they are still getting the same or better data that they would through the Dash button. But the brand now also gets really good data.

Here’s an example of data that brands are not getting that they can get from a DRS-enabled device-and-package system:

Say some households are doing laundry mainly on weekends. Another set of households does laundry any time of day on any day. Then another household does a massive amount of laundry once a month. What does that tell you about the household? And how might you market your product differently to those households? And how might you develop products differently for those households?

Right now, brands don’t get a lot of that data about how people are using their product. But with some basic data on timing and amount of use, you start getting a lot of insight into how to best serve your consumers.

The data that each device supplies is basic: when is the product being used, how much is being used, the approximate location and when does it need to be reordered. It’s when you get a quantity of that data from many, many devices out in the world, that you can find good insights.

You can also fuse “use” data with other publicly-available sources—for example, weather data. Or you could use historical data to predict future demand.

All this can make marketing efforts more fruitful and more accountable. It could potentially improve supply chain efficiencies. It can lead to better product development because you get a better understanding of niches of your consumers you weren’t aware of before.

What about consumer privacy?

Williams: My background is in user experience and human/computer interaction. So, user privacy is something I’ve been thinking about for longer than I have been thinking about packaging.

There are two general areas to pay close attention to:

1. Regulatory: What do we lawfully have to do to protect consumer privacy? If encryption is required, you have to do it locally, not remotely, because it’s safer. Data should be anonymous or pseudonymous. People get right of access to their data and the right to erase data. Generally, companies are finding it easier to have just one privacy policy instead of having one for the U.S. and one for Europe. And then you have policies like HIPAA, [the Health Insurance Portability and Accountability Act]. We have defined regulations we have to adhere to.

2. We need to respect people’s privacy…that’s the basic thing. I did survey questions on this to understand consumers’ attitudes a little bit more. If you’re taking data from people, you really need to be giving them something valuable back. And the data you get from them has to pertain directly to what you’re giving them. If you can do that, you’re being respectful without being intrusive. .

We do want to be careful about what data we take from them. The data from each device is basic—the data that the brand would get should be pseudonymous—like a user ID, but it’s not going to link to a person’s name and address or credit card information.

So, it’s like the benefits of Big Data without the personal details, right?

Williams: Right. If a company wants to know about product usage, they don’t get a ton of value knowing how I personally use that product. They would get more value out of knowing how everyone in my area tends to use that product.

How did you test this concept before launching the smart packaging?

Williams: We did a lot of market intelligence and research beforehand. What can you do with smart packaging and what problems can we solve? Where is the market most mature? Where is there white space?

We did surveys of CPG [consumer packaged goods] companies’ attitudes towards smart packaging, consumer attitudes towards ecommerce, subscriptions, auto-replenish, privacy.

We built proof-of-concepts. We just kept putting stuff in front of customers. Every time a customer would visit—a brand owner or a retailer—we would do some kind of demo for them. We would take their feedback and then come back and modify our work. We’ve made a lot of updates to the application, to the brand dashboard. We really refined the feature set based on the feedback we were getting from customers—and from what we were collecting from consumers directly.

Do you have any customers using this smart packaging yet? If so, who and what packaging are they using?

Williams: Not at this moment because we just announced this partnership. It’s really early days still. And we can’t disclose anything we’re doing with specific customers before the products are actually out on the market.

The news about this technology went out May 30. What has been the response so far?

Williams: We publicly announced on May 30 but started talking about it to some customers before the launch under non-disclosure agreements. I can’t reveal specific customers, but I’ve been on a lot of calls the last couple of weeks about this and there is a great deal of interest in taking discussions to the next level.

Anything else about the development I haven’t thought to ask that you are compelled to tell me?

Stodola: We defined a path forward because Jabil has capabilities that are unique. With our core competencies in connected technologies, what we can offer brands and retailer-brands is a real value based on the trends we see in omni-channel, ecommerce and direct to consumer.

Now as a DRS partner with Amazon, we’re going to help them put more devices into the world that are going to call for products. They’ve got the fulfillment services set up to ship those. It’s kind of like a plug-and-play-ready ecommerce module. Then add to that the ability to connect the consumable to the device, we feel like we are a uniquely positioned packaging company to offer our customers end-to-end solutions.

We’re trying to facilitate it in a way that’s more natural. It’s more natural when the package is talking to the device in the home. You choose what products you want to put in the system and manage that yourself. It’s with or without an app. We’re just helping to enable solutions for our customers—brands or retailers that would like this capability—to operate with the protocols already aligned to the DRS modules.

We can handle the primary package, a consumable, a device—all core ways brands can move products to the customer—and then offer ways to connect them together.

Williams: I think we’re just part of a pretty big sea-change in brands and retailers really embracing ecommerce and omni-channel distribution…in ways that will make life a lot easier for consumers. I’m going to bet that you hear more about auto-replenish this year, not just from us but from retailers and brands.

Also, look for us to develop core-packaging solutions for ecommerce—sturdier primary packaging that doesn’t require as much secondary packaging protection, better caps and closures, designing for the size and shape of the delivery box and the consumer’s shelf at home, that kind of thing. “Smart” packaging is about the whole package, not just fancy electronics.

About the Author(s)

You May Also Like