State of "green packaging"

January 30, 2014

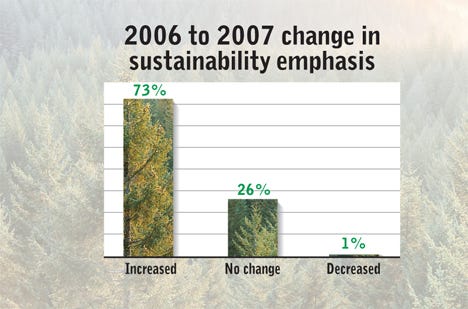

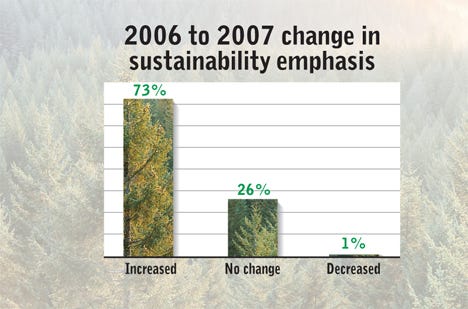

Sustainability is a rapidly increasing concern to those who manufacture and use packaging, according to the results of a just-completed survey sponsored by the Sustainable Packaging Coalition (SPC [www.greenblue.org]) and Packaging Digest. The benchmarking study, which includes responses from 1,255 persons involved in packaging, shows that 73 percent of the respondents report that their companies have increased an emphasis on packaging sustainability during the last year. And while the awareness factor surges, adoption rates seem to lag as packaging businesses slowly incorporate sustainable practices into their business strategies.

No doubt, sustainability is a hot button for the industry, and its impact is likely to grow over the coming years. Driven primarily by environmental concerns, such as global warming, energy consumption and limited natural resources, sustainability in packaging increasingly generates interest due to its pervasiveness across cultures and geographic boundaries. Modern lifestyles, which demand longer product shelf life and create intense competition among brands, have been major drivers for increased usage of packaging, now seen as as a leading contributor to wastestreams. Pressure is mounting on the industry to act now.

We collaborated with Packaging Digest because with all the recent hype and misinformation circulating about sustainability, we felt it was really important to provide a far-reaching and unbiased research benchmark for the industry,” says Anne Johnson, director of the SPC.

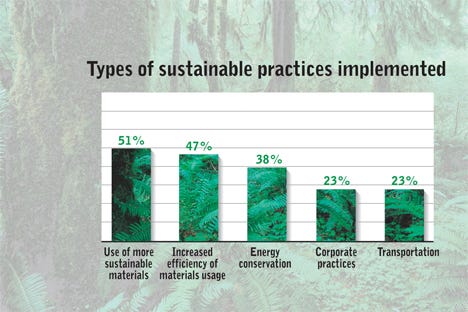

“The results of the research show how different packaging stakeholders are addressing 'green' issues in four key areas,” says Mark DiVito, group research director for Reed Business Information. “These issues include awareness and adoption levels on sustainability, how it is affecting business strategies and decision making, what activities are being undertaken and how companies are setting goals and measuring their success in the implementation of sustainable practices.”

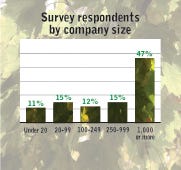

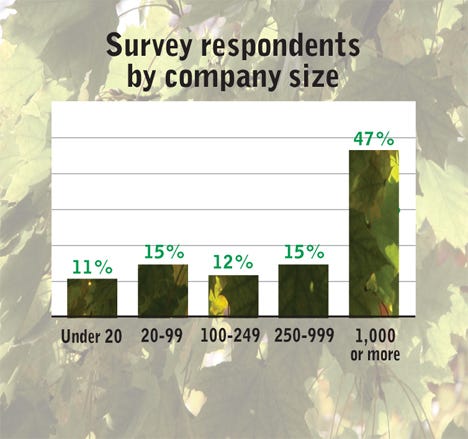

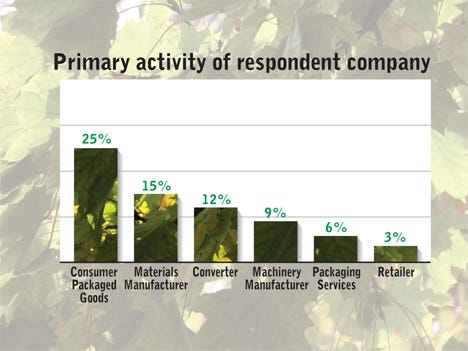

Survey respondents were drawn from the SPC membership, as well as subscribers to Packaging Digest and Converting Magazine. The companies they represent are drawn from a cross section of those involved with packaging. The largest number of participants comes from the consumer products goods companies (CPGs), followed by materials manufacturers, converters, machinery manufacturers, packaging services and retailers.

Interest in sustainability practices apparently cuts across many roles within a company. About one-quarter of the respondents identified themselves as executive management on corporate staffs, while respondents from engineering, marketing/sales and research and development each accounted for about 20 percent of the survey participants. Roughly 10 percent were involved in packaging design. The study also revealed that a number of companies are creating positions for persons whose job it is to shepherd sustainability efforts within a company.

As one respondent said: “The challenge is to get everyone on the same page about the relative importance of sustainable packaging. Various departments are applying practices and principles to varying degrees. We've had a vice president of Responsible Livelihood (Sustainability) for the past eight months and have begun the coalescence of all functions.”

From the research, it appears that sustainability is reaching new levels of awareness across the industry, especially among companies with more than 1,000 employees and those with formal, written sustainability policies, where 46 percent of respondents rated themselves as “very familiar.” Still, only 21 percent of all respondents claimed they were very familiar with the issues of sustainability in packaging. Nearly 40 percent said they were “somewhat familiar,” while 10 percent said they were not familiar at all.

Overall, 14 percent of respondents said their companies have formal sustainability policies. Among companies with more than 1,000 employees, 67 percent of respondents say they have established formal sustainability policies. Among privately-owned businesses, 62 percent say they have no sustainability policy or that it is under development.

DiVito pointed out that, over time, the adoption rates for most new ideas and technology tend to follow a classic bell curve, with a few early adopters pioneering an innovation, then rapid adoption among secondary adopters, followed by a rapid decline in adoption rates, leaving only a few stragglers behind. However, he says, the data from this survey shows a slower-than-expected implementation of sustainability practices, in which the adoption rate looks like it will be spread over a more substantial period.

Among the sustainability innovators and early adopters, a few characteristics did emerge, according to Divito. This group tends to work for larger organizations that have a high level of commitment at the corporate level, with staff dedicated to the sustainability function. Their primary activities include the CPGs, materials manufacturers and packaging converters.

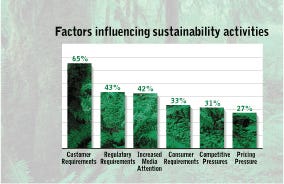

The survey showed that early adopters are implementing sustainable practices across a number of areas and in an in-depth manner. Another key factor is that the innovators say they are being pushed by customers, who are either seeking or requiring suppliers who utilize “green” protocols.

Once packaging companies have become aware of the need for sustainable practices, the survey shows they have some difficulties defining “sustainability” and how they develop and implement practices that make it a reality. They were asked to rate the importance of factors included in the SPC's definition, which is widely accepted as the industry's best characterization of sustainability.

Recognizing that packaging is an important part of business, respondents from all groups said sustainability must meet market demands for performance and cost. This translates into the market saying that it wants to protect the environment, but not at any cost. The next most important factor is that packaging be beneficial, safe and healthy thoughout its life cycle.

“Based on all the junk science being touted as fact by the Kool-Aid drinkers, the definition is the challenge,” says one respondent. “How do you define what no one can agree on?”

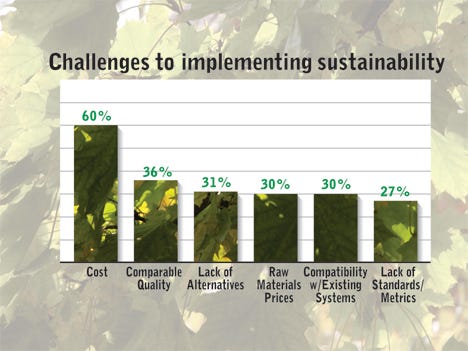

Far and away, the biggest challenges to making their current processes more sustainable are higher costs and being able to produce packaging of comparable quality, respondents say. However, about a third of the group also expressed concerns with increasing raw materials prices and their ability to institute sustainable practices using their existing packaging systems.

One participant pointed out how difficult it is to find cost-effective solutions that meet the sustainability criteria. “Without cost-effective solutions, they (sustainable practices) are not sustainable in the long run,” he said.

Being able to find good metrics that measure the success of their programs is also a consideration. Some are using lifecycle analysis (LCA) to assess the environmental impact of a given product or service throughout its lifespan. The goal of LCA is to compare the environmental performance of products and services and be able to choose the least intrusive alternative. The assessment, which can be costly and time consuming, requires a review of the raw material production, manufacturing, distribution, use and disposal and all transportation steps.

Another survey participant emphasized the importance of accuracy and honesty in reporting sustainability efforts to customers. “We've seen competitors explain how a product meets sustainability initiatives and found their statements to be ludricrous. It seems you can twist anything to put it in a more positive light,” the respondent said.

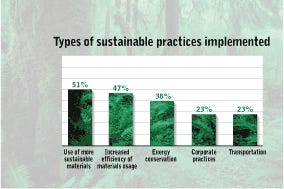

The mantra of sustainability has become “Reduce, reuse and recycle.” Survey respondents say packaging should be designed to optimize materials and energy consumption, while maximizing use of renewable or recycled materials. Nearly one-third showed concern that the packaging be made from materials that are healthy in all probable end-of-life scenarios. Among the criteria used to evaluate sustainable practices, the highest rated was use of recycled material, followed by careful consumption of materials, controlled energy consumption and packaging manufactured without the use of toxic or harmful chemicals.

Of those who participated in the survey, over two-thirds said their first priority is to make use of recycled materials, followed closely by ensuring that all materials used in the packaging are renewable. Utilizing renewable energy resources is also a priority, but there were indications that they face a lack of affordable alternatives for energy.

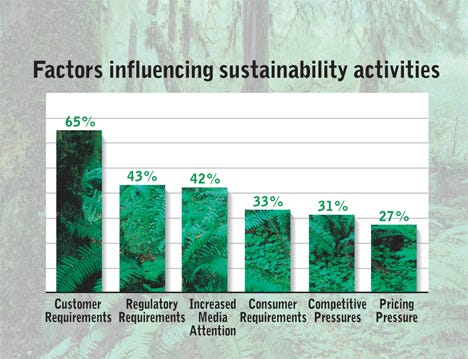

When it comes to impact on corporate decision making, Divito says, the leaders tend to tie their efforts into an overall sustainability strategy. While they are more apt to have customer requirements drive their sustainability activities, other factors also influence their involvement in sustainability. Costs, comparable quality and metrics all are challenges to their efforts to conduct business in an environmentally friendly manner.

Another respondent summed up, saying: “There is corporate-wide interest in sustainable packaging. Without a mandate from 'on high,' it will be challenging to implement a program or process which addresses sustainable packaging to its fullest.”

Finally, respondents also revealed some of their personal attitudes toward sustainability, saying Wal-Mart is generally regarded as the “greenest” company. About half of those who work at companies with sustainability policies believe this makes a difference in their personal purchasing decisions.

As for the most environmentally friendly form of packaging, respondents favor paper-based products. However, they also recognize that any form of packaging has some impact on the earth's environment.

Participants in the survey also said that they rely on a number of sources for credible information on sustainability, with industry associations and trade publications rated as the most authorative sources.

About the Author(s)

You May Also Like