Fifth annual survey shows sustainability remains a driving factor in packaging decisions

January 30, 2014

Chasing arrows

For half of the last decade, an annual study by Packaging Digest and the Sustainable Packaging Coalition has shown sustainability's steady growth as a driver of change and innovation in the packaging sector. Could that momentum be slowing?

The 2011 Sustainability in Packaging study -the longest-running benchmarking survey on this topic in the industry-indicates some slippage on key questions. This does not mean that sustainability's importance among packagers has declined. Its impact is still growing, albeit at a slightly slower pace.

This exclusive survey was conducted in September 2011, and it drew 6

Sustainability

74 responses from a cross section of the packaging industry that includes consumer packaged goods companies (CPGs), retailers, packaging services and converters, as well as machinery and materials suppliers.

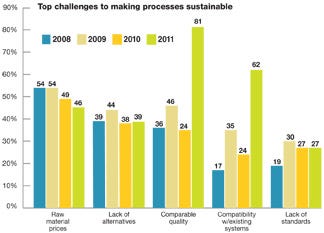

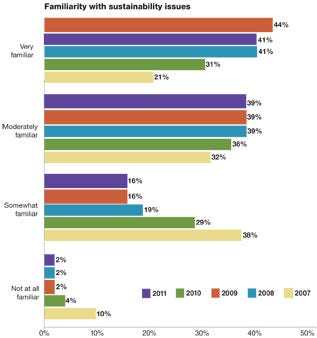

For example, the number of respondents reporting high or moderate familiarity with the issues of sustainability dipped to 80 percent in 2011 versus 83 percent in the 2010 survey. Of course, that number remains well above the 52 percent who reported high or moderate familiarity with sustainability in 2007, the first year the survey was conducted.

Emphasis g

Sustainability

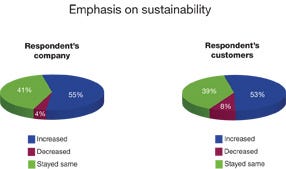

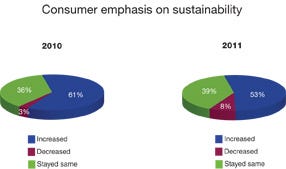

rows, but more slowlyAt the same time, a growing number of study participants (41 percent) say the emphasis on sustainability within their companies has stayed the same in the past year, compared to 31 percent a year ago. The number who said the emphasis on sustainability had grown within their company was 55 percent in 2011. While sustainability held its own within most of the respondents' companies, 8 percent said they believe consumers' emphasis had declined in the past year.

When asked how they'd rate their company's success in achieving sustainability, just under one quarter of respondents say the business they work for had achieved levels beyond what similar companies had achieved. A majority of 59 percent rated their companies on a par with similar companies, and 17 percent say they were not faring as well as competitors.

For the first time, the survey also asks at what level is participation in sustainability activities being driven within companies. The answers were fairly evenly split, with 32 percent saying sustainability is a C-level initiative, 31 percent saying that it is driven by individual champions, and the remainder by departmental or inter-departmental task forces.

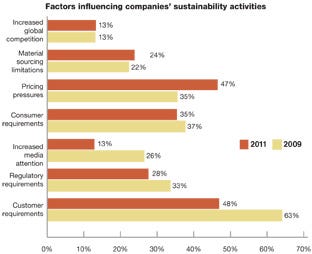

Consumer demand (48 percent), pricing pressure (47 percent) and retailer/brand owner requirements (35 percent) were cited most often as the main influences on companies' sustainable packaging efforts, results show.

Sustainability

Split on economy's effects

The survey also shows a fairly even split on how the economy affects sustainable development, with 19 percent of respondents saying customers simply are not willing to pay higher prices for sustainable packaging, while 18 percent say the economy has had little or no effect on their sustainability goals or efforts. Another 16 percent say conditions have merely slowed or postponed sustainability efforts.

Economic conditions across the country were cited as a major reason that some business have scaled back their activities in sustainable packaging.

"Customers have been affected by economic conditions and have focused the attention away from sustainability and more toward cost savings,"according to one survey respondent.

Another states that: "Consumer pricing sensitivity, corporate profitability targets and short product development times limit our ability to utilize sustainable materials which are often more costly, have limited supplies and require additional compatibility testing. In some cases, the sustainability efforts can have long-term benefits, but the corporate objectives are expected in the short term."

This view was supported in the response to another where 35 percent of participants said managing costs is the business factor that will have the greatest impact on their companies' strategic direction over the next five years. More than a quarter of the participants also listed pricing pressures and operational efficiency as strategic factors.

Still, some companies have taken quite the opposite view. Exactly one-fourth of those included in the survey highlighted sustainability as a driver of in their company's strategic direction. A whopping nine out of 10 respondents say being more efficient and saving costs is an important part of any sustainability effort.

"Sustainbility initiatives, when properly chosen and implemented, actually reduce costs and improve marketplace differentiation," says one respondent. "Tough economic times make accomplishing these two goals more important than ever before. They actually fuel our interest in sustainability efforts."

As one participant says: "Current economic conditions may have slowed implementation of planned activities, but they were not removed from the strategic plan."

Leaders recognized

Again in 2011, Walmart has maintained its predominance as the leader among retailers for its sustainability practices, according to the study, followed by Target and Whole Foods Markets.

Among CPGs, Procter & Gamble was most-recognized for sustainability, followed by Coca-Cola and Pepsico, which both introduced plant-based packaging in 2011.

For packaging materials suppliers, International Paper, DuPont and NatureWorks all received mentions, although none of these companies garnered more than 10 percent of the respondents' votes. Only Bosch, which was identified by 4 percent of the respondents, tallied enough votes for mention among machinery suppliers. These scores may indicate a highly fragmented market, but also indicate that there are plenty of opportunities for packaging market suppliers to distinguish themselves on sustainability issues.

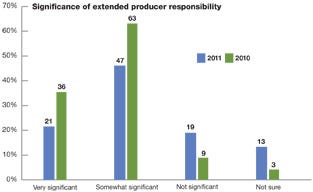

Concerns about EPR soften

The survey asked participants how significant extended producer responsibility (EPR) for packaging will be as an issue for the next five years. EPR uses government regulation and financial incentives such as deposits or taxes to encourage manufacturers to design environmentally friendly products by holding producers liable for the costs of managing their products at end of life. Nearly 70 percent say the issue will be "somewhat" or "very significant" in that period, down from 89 percent in the 2010 study.

Sustainability

One element of concern expressed repeatedly throughout the survey is that companies want regulations to be consistent in their markets so they can produce packaging to meet general needs. That is likely the reason a majority support EPR regulation being mandated at the Federal level, if at all (11 percent think there should be no government interference).

Otherwise, packagers say they will have to develop different types of packaging or make sure that what they use meets the strictest level of regulation for various markets they serve.

"Varying regulations make it difficult to determine what's needed for each product and especially for products shipping to customers worldwide," according to one responent.

Sustainability

Sustainability

About the Author(s)

You May Also Like