Bottled water poised to flood Indian market

January 30, 2014

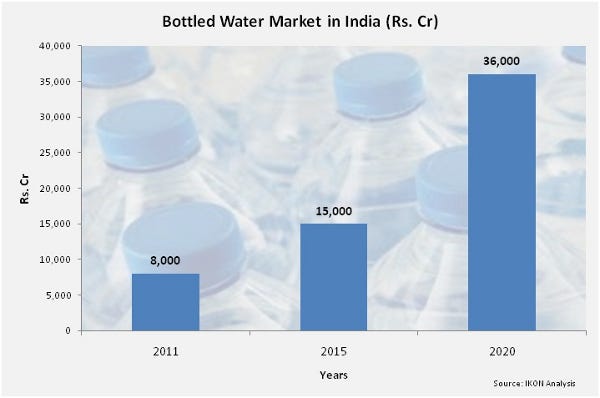

According to research from IKON Marketing Consultants, the bottled water market in India is growing at 19 percent CAGR and is likely to maintain that growth momentum in years to come.

IKON's estimates the Indian bottled water market may be worth around Rs 36,000 Cr by the end of the current decade.

Bottled water market in India

Market conditions

• In terms of volume, the demand was estimated at around 532 million cases of small pack during 2010-11.

• Global bottled water market has increased by 40 to 45 percent over the past five years currently valued at around US$ 85-90 billion. Indian bottled water market is around only 2 percent of the global bottled water market.

• The market is shared by three types of players: (1) national brands having pan India presence worth around Rs 4000 crore, (2) region-specific local brands that are made by registered plants but serving into region-specific market worth around Rs 2400 crore and (3) the unorganized local brands that are made in homes usually in bulk and pouch packing having turnover of around Rs 1600 crore. There are more than 2,500 brands, nearly 80 to 85 percent of which are local.

• Even though the market is regularized, it is shared by both, organized and unorganized players. Currently 80 percent of market is in the hands of organized players (national and region specific brands) and 20 percent of the market is in the hands of unorganized players (unregistered non-branded).

• The non-traditional category—that is, bulk pack (more than 5 L)—is gaining grounds by acquiring almost 44 percent market share. 20 L jar is a new darling even for national players, which according to IKON's estimates is valued at more than Rs. 3500 crore, growing at around 28 percent.

• Rising trend of bulk water consumption in homes and institutional segments will pave the way for bulk water pack to acquire half of the total bottled water market within next four to five years. The major growth contributors will be the mushrooming growth of bulk water pack suppliers due to less entry barriers to the industry and almost negligible cost of industry exit, range bound supply and the continuous rise in population with inadequate drinking water facilities, says Taruna Sondarva senior consultant at IKON.

• In terms of Urban Rural market segments, 84 percent of the market is occupied by urban and 16 percent is occupied by Semi Urban & Rural market. In both the segments, the small pack (packing below 5 litres) rules the market.

• South India is the biggest consumer of bottled water, due to water-starved areas.

• Out of more than 3,300 registered plants manufacturing bottled water in India, around plants are located in Southern states estimates, there are more than 12,000 unregistered plants in India share.

Market trends

• Consuming bottled water in India is become necessity now. The Indian consumer is perceiving bottled water as safe to consume, worth to spend on it and less of brand loyal.

• Bottled water in India has taken off, thanks to the organized retail format in India.

Competition

• Currently the small packing companies are holding maximum market share due to easy affordability and availability. 1-liter water bottle holds significant market share. However, in recent years the institutional supply is picking up with supply of bulk packs.

Market growth drivers

• The major contributing factors for growth are rise in spending capacity, rising population,

increasing scarcity of pure drinking water and increasing awareness about the health

consciousness among the Indian consumers, increase in per capita consumption along with

growing market segments for bulk water.

Major market challenge

• Rising environmental concerns and high transportation costs, along with difficulty in brand

recognition, are proving major bottlenecks for Indian bottled water market.

"I am highly optimistic about the future of Indian bottled water market. Increasing scarcity of

safe drinking water, changing life styles and aggressive expansion by market players may lead

this industry to be the next oil industry in coming decade," says Azaz Motiwala, founder and

principal consultant of IKON Marketing Consultants.

Source: IKON Marketing Consultants

.

About the Author(s)

You May Also Like