Is 2.2 million tons of new BOPET film capacity enough?

BOPET chart

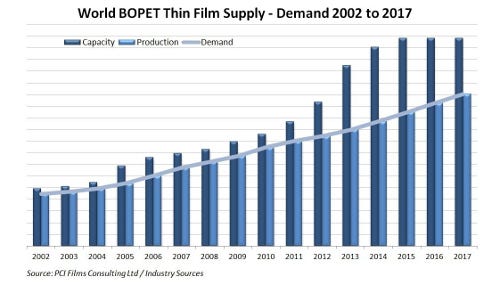

After the supply shortages of commodity bi-oriented polyester (BOPET) thin films in 2010, the global BOPET film industry has done its best to ensure global supplies will not dry up again - or has it? PCI Films Consulting's latest review of the commodity BOPET thin film market notes a significant increase in film extrusion capacity in recent years and more planned for the next three years but still believes 2 million tonnes (about 2.2 million U.S. tons) won't necessarily guarantee supplies to Western markets.

Since the supply shortages of 2010, demand in the global thin (i.e., less than 50 micron thickness) BOPET film market has grown by only 250,000 tonnes (5% annually), awaiting the expected global recovery. But this growth has been more than matched by the installation of 700,000 tonnes of new film extrusion capacity.

Over the next five years (2012 - 2017) the global market is expected to use another 900,000 tonnes of thin film and suppliers are gearing up for this with investments in an additional 1.3 million tons of new capacity - surely more than enough to meet demand in the West?

Two reasons for concern

Not according to one of the report authors, Simon King who notes, "These headline numbers are misleading for two reasons: 1) nameplate capacities are never realised and a more realistic level of production from this new capacity could be as low as 75% of nameplate; and 2) most of this new capacity is being installed in China and Chinese film producers don't seem to be able to connect with European and North American customer needs. Many do not see them as realistic alternatives at present."

Westernized regions, such as Europe and North America, continue to be major importers of BOPET thin films because their local industries are not large enough or competitive enough to meet local demand and regional producers appear to be doing little about it. PCI reports the running up of new capacity in Turkey and Poland and two new plants in the US but these will do little to absorb the current volume of imports into these regions, let alone meet future demand.

While the current investment climate is weak, buyers are encouraged to gain a broader understanding of potential suppliers and their capabilities in commodity BOPET thin films outside of traditional supplier networks to ensure continuity of supplies in the coming years.

About PCI

PCI Films Consulting have been analyzing the global flexible packaging substrates market for nearly 20 years, and their subscription-based Quarterly Business Reports have provided expert analysis of supply chain trends to support the decision making of raw material suppliers, film, aluminium foil and special paper producers, converters and major end-users throughout Europe and the world.

Source: PCI Films Consulting Ltd.

.

About the Author(s)

You May Also Like