Food industry faces tides of change

January 29, 2014

Using the forces of nature as a metaphor for the powerful and unpredictable elements shaping the world's food and beverage industry, a new study identifies four core issues as drivers of the industry through the next several years. Sponsored by three industry associations, Forces 2001: Food Processing in a New Century reports that globalization, the shifting retail and foodservice market, business technology, and the changing consumer are the issues that will dictate the business strategies of the world's food providers during the next two to three years.

The biennial report's debut issue, created as a benchmark for future industry surveys, also includes the results of a survey of more than 50 food processing CEOs, who contributed their insights on future industry developments. The study was commissioned by the American Meat Institute, the International Association of Food Industry Suppliers and the International Dairy Foods Association, and was conducted by Promar Intl.

Today's worldwide food market

Providing a taste of current market conditions, Forces 2001 relates that the food industry is a major element in the economy of every country in the world. In the U.S., the food industry is a trillion-dollar industry, contributing about 10 percent of gross domestic product. In Canada, food and beverage industries account for 13 percent of GDP; in Mexico, 11 percent; and in the European Union, 12 percent. Latin America is cited as a significant and growing area as a food producer, as a market for the food industry, and as a potential partner in new ventures.

Despite the slowdown in the U.S. economy, the food industry is less vulnerable, says the study, than many other industries. However, the dynamics may shift: People may decide to eat at home more often, with some loss to foodservice and restaurant sales and gains for those companies with product lines primarily consumed at home.

About half the food processing executives surveyed anticipate some increase in costs in the next few years. While meat and dairy CEOs expect higher expenditures on marketing and R&D, other executives foresee increased spending on distribution. Addressing labor–the biggest cost in the food chain–the study notes that while dwindling availability of qualified workers has pushed labor costs upward in the U.S. in recent years, a softer economy is reversing that trend, and labor costs are decelerating rapidly.

Other factors food manufacturers should consider, the study says, are the availability of capital, energy prices and the cost of ingredients.

Globalization

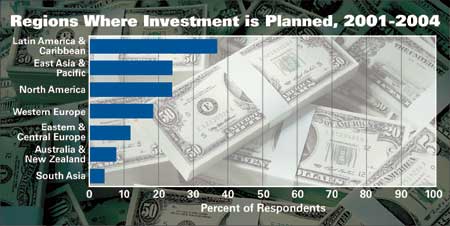

Globalization is reducing artificial boundaries and opening up trade between nations at an incredible rate, the study says. Today, the volume of world food trade is valued at between $300 billion and $400 billion ($U.S.) per year, with Western Europe, Asia, North America and Latin America as the major regional players. Over recent decades, Forces suggests, there has been an increased volume and value of trade in processed foods relative to agricultural commodities, with processed foods making up more than 60 percent of the total value of world food trade.

Developed countries are the major exporters of processed food, with France, the U.S., Germany and the Netherlands leading the list. But, a number of lesser-developed countries, such as Brazil, China, Taiwan and Thailand, are also becoming important suppliers of processed food. The U.S., with a 9-percent share, risks being left behind, the study warns, as other nations aggressively pursue preferential agreements that could preclude the U.S. from markets where it has important cost advantages. Greater access to foreign markets requires aggressive trade policies to lower tariffs and eliminate trade-distorting subsidies.

As for imports, the U.S. is the top importer of processed foods, followed by Germany, Japan, the U.K., France and Italy. According to the U.S. Department of Agriculture, these six nations account for more than 61 percent of the processed food imports.

The strong increase in the flow of trade over the past decade has been encouraged in part by multilateral and regional trade agreements, such as NAFTA in North America, MERCOSUR in Latin America, and the European Union. Going forward, the study indicates, the two international bodies that will have the greatest impact on the global food trade industry are the World Trade Organization and Codex, under the auspices of the United Nations, and more specifically, under the Food and Agriculture Organization and the World Health Organization.

In the case of Codex, government representatives from more than 150 countries have been working for years on an international food code designed to ensure that food is safe and labeled properly. This code, says the study, will not only affect what food processors want to export, but also will affect all the products they will be competing with in their own, domestic markets.

Also driving globalization is the rise of multinational food companies, which are changing the world market by creating more efficient transportation systems, improving information networks and diversifying into new markets. These firms hold some strong advantages, including access to high-level R&D resources and worldwide distribution systems, as well as internationally known brands and economies of scale.

The U.S. is a major player in the multinational game, with seven of the 10 largest and 21 of the 50 largest food-processing companies in the world located in the U.S. Foreign direct investment both by U.S. investors abroad and by foreign investors into the U.S., has played a significant role in the globalization of food processing.

Shifts in retail, foodservice markets

The rise of warehouse clubs and a move by retail food customers toward foodservice venues is causing a significant shift in the retail food and foodservice markets, which will greatly influence food processors, says Forces 2001. In recent years, as warehouse clubstores and specialty stores have gained in popularity, food marketing has changed dramatically. In the U.S., the supermarket share of grocery sales fell from 78 percent to 70 percent between 1992 and 1997, and has continued to drop.

Food retailing in general has also lost ground to the foodservice industry due to the transformation of economies, the entry of women into the workforce, and the growth of a worldwide middle class with an increased demand for leisure time. As a result, in most markets, the rate of growth in foodservice sales is outstripping that for retail packaged food products. According to the National Restaurant Association, U.S. restaurant sales reached $380 billion in 2000, up 5 percent from 1999. By 2007, fast-food restaurants are expected to account for nearly 58 percent of all take-out food sales in the U.S. And, this shift is apparent across the globe.

In response to these threats, supermarkets have gotten bigger to accommodate other services from banks to pharmacies in order to provide increased customer service. Another way they have responded is by increasing their market share through consolidation. In the U.S., between 1992 and 2000, the largest 20 retailers increased their market share from a little over a third to nearly 80 percent; the top eight retailers more than doubled their share to more than half the market; and the share of sales for the four largest retailers rose from 16 to 37 percent.

This has big implications for food processors. In the survey, food executives said they consider this concentration in the food chain a threat, and they expect retailers and foodservice companies to gain power at their expense over the next three years.

In an attempt to match their customers' corporate size, the food processing industry has also gone in for mergers and acquisitions. In the U.S. from 1993 to 2000, these mergers averaged more than 150 a year, with a high of 230 in 1998.

Business technology

While the forces of business technology, specifically the use of e-commerce and the Internet, have not yet been completely felt by the food processing industry, Forces 2001 notes it is clearly not a flash-in-the-pan. The potential benefits of business technology–better inventory management, reduced processing costs, reduced product costs and, in the marketplace, improved discovery and visibility in commodity and product trading–are just too great to ignore.

While the association's survey of CEOs shows that dairy, meat, and other processing companies presently buy only about 2 to 4 percent of their production inputs online, it indicates they expect that amount to rise to 14 to 16 percent by 2004. As an example, Dairy.com, a marketplace for the dairy industry, recently announced its online transactions, primarily in cream, had topped $100 million. Although still a very small share of a multibillion-dollar industry, it is a significant bellwether for the future.

Meanwhile, marketing of finished food products online is still in its infancy, with respondents putting the share of sales at about 1 percent. But again, there is considerable optimism about the pace of development over the next three years. Meat executives look for their share to rise to about 10 percent, while the other industries see a 2- to 4-percent increase as likely.

There is also a growing use of e-commerce among restaurant and foodservice operators. As an example, the International Foodservice Manufacturers Association believes that about 39 percent of restaurants order at least some of their supplies online, and that this amounts to about 16 percent of their annual purchases–a figure predicted to rise to 30 percent by next year.

Changing consumer

Despite the importance of the previous three forces identified, Forces 2001 emphasizes that the most important element affecting the food processing industry is the consumer.

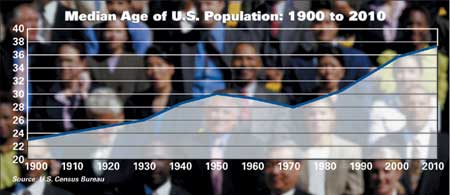

Demographics are critical in predicting consumer preferences. The populations of Europe, Japan and the U.S. are aging, and this is changing their food and beverage choices. In contrast, the very young age profile in most developing countries calls for a quite different product focus.

Another key factor driving consumer choices is income-polarization. For instance, in the U.S. in 1990, approximately 15 percent of households had incomes below the poverty line, while another 15 percent was considered wealthy–with the vast majority in the middle class. By 2010, the percentage of households living below the poverty line is predicted to increase to 20 percent, while the wealthy class will double to 30 percent of all households. The middle-income group will shrink to 50 percent, with a clear distinction between those who are struggling (20 percent) and those who are comfortably middle-class (30 percent).

The impact of these changes on the food sector will be significant, bringing about corresponding changes in spending patterns. As income distribution becomes more polarized, food processors will need to market differently to low- and high-income consumers.

Consumers' concerns about any aspect of food production, processing or sales translate directly into choices about the food they will buy. Two concerns of growing importance to today's consumers are biotechnology and food safety. Biotechnology: Since their introduction in the mid-1990s, more than 40 genetically modified crop varieties have been developed to provide more and better food. But, public policy has not kept pace with biotechnology developments, and reaction to GMOs around the world has varied. In North America, biotechnology has been much of an issue for consumers, as there is high consumer confidence in the safety of the U.S. food supply.

According to the USDA, about 68 percent of soybean, 69 percent of cotton and 26 percent of corn acreage planted by American farmers in 2001 used genetically modified seeds. The global area devoted to growing biotechnology crops has increased from just less than five million acres in 1996 to almost 110 million acres last year.

Biotechnology is poised to make a huge difference in the availability of nutritious foods for a world population that is expected to reach nine billion people by the middle of the 21st century. But this won't happen unless people are confident that GMOs are safe and beneficial.

Food safety: With several serious outbreaks of foodborne illness in the U.S., Europe and Japan in the past five years, these governments and the food industry have put a renewed focus on prevention efforts and stepped-up inspection. Nonetheless, the issue of foodborne illness requires a steady watch. Consumer education and good working relationships with food regulators will continue to be critical in managing this potentially explosive issue.

Meanwhile, in a quest for peace of mind about what they are eating, some consumers are turning to organic and "natural" foods, and this market is growing at a rate of up to 24 percent a year in the U.S. and Europe. Consumers are also demanding processed food that they perceive as more healthful than in the past, such as low-fat and no-fat foods, and foods low in cholesterol and sodium.

The health food market continues to grow and has evolved to include foods with such enhancements as the addition of calcium, soy and functional herbs such as ginseng.

Consumer concerns are often the basis for governmental food policy. In the next several years, the study predicts, consumers' concerns over biotechnology, nutrition labeling, and the labeling of nutraceuticals and functional foods will lead to increased public policy regulation.

For information on obtaining a copy of the complete study, visit www.worldwidefood.com or contact Beverly Posey at [email protected] or 202/737-4322.

More information is available:

Study: American Meat Institute, 703/841-2400. Circle No. 235.

Study: International Association of Food Industry Suppliers, 703/761-2600. Circle No. 236.

Study: International Dairy Foods Association, 202/737-4332. Circle No. 237.

Consulting: Promar Intl., Inc., 703/739-9090. Circle No. 238.

About the Author(s)

You May Also Like