Proactive asset management for pre-owned packaging machinery

November 23, 2016

Ben Potenza, vp marketing at EquipNet Inc., a global online marketplace for used manufacturing and production equipment, offers advice for buyers and sellers of second-hand machinery.

What are the drivers behind the current surge in demand for second-hand manufacturing and packaging equipment?

Potenza: The global economic downturn has had ramifications that endure today, and while the North American industry as a whole rallied strongly, ensuring business growth is backed up by operational efficiencies and prudent investment remains a priority for most organizations.

The United States, Canada and Mexico maintained their dominant position in the global packaging market during this challenging period. The increasing consumption of packaged goods across a range of consumer areas in these geographies continues to provide a major growth opportunity for the North American packaging market, which is predicted to rise to $186 billion by 2017 (1).

A number of key social and market trends have also had a major impact on developments in packaging in North America over recent years. The increase in smaller households has led to an accompanying rise in demand for smaller pack sizes. Continuing consumer demand for convenience has driven packaging developments in the food and drink sector, while the growing number of people interested in health and beauty products has led to packaging developments in the cosmetics and toiletries sector. Alongside this, growing sustainability concerns continue to drive manufacturers to reduce their environmental impact, and minimizing waste ranks high on the global packaging industry’s agenda.

Amidst these changes, businesses in this sector are now facing increasing competition from emerging economies and the threat of declining market share, with Asia predicted to represent over 40% of global packaging demand by 2018 (2). This puts increasing pressure on North American packaging firms to grow, while controlling expenditure on new manufacturing equipment in the face of the ever-changing demand for new packaging developments.

Businesses of all shapes and sizes—from cutting-edge research companies and burgeoning SMEs, to multi-national, multi-facility brand giants—are now recognizing the benefits and reaping the financial rewards of buying second-hand equipment, and selling or redeploying their own under-used equipment.

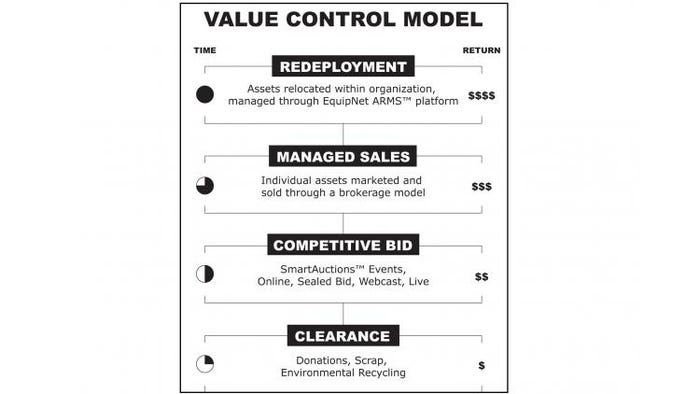

Figure 1: EquipNet’s ‘Value Control Model’ shows how redeployment, negotiated sales with managed pricing through an on-line marketplace, competitive auction events and clearance programs fit together to deliver a consolidated service that ensures a ‘seller’ company achieves maximum return and at the same time sees equipment come into the channels that are used by a ‘buying’ company. In many cases, a business is both a seller and a buyer at different times.

Based on your years of experience in this market, what’s been developing in this field more recently?

Potenza: The heady pace of new product development (NPD) in consumer goods is changing the face of production lines on an almost daily basis. Manufacturing processes are constantly evolving as producers vie for consumer attention and spend in an increasingly busy marketplace. Packaging plays a vital role in the supply chain, maintaining product quality, attracting buyers at point of purchase, informing consumers and enhancing their product experience. Alongside the use of new materials and components in the products themselves, developments in packaging production are driving a similar transformation.

As new product lines and their associated packaging are launched and old ones adapted or replaced, or as companies merge, relocate and open new facilities, equipment can fall out of use. With the fast pace of NPD, it is not surprising that millions of dollars are now tied up in manufacturing equipment. Redesign of packaging and use of new materials for marketing and waste reduction purposes can all too easily lead to machinery being side-lined. Importantly, industry surveys suggest that an average of around 10% of a company’s asset base is lying idle, and that most do not have good visibility of these underutilized assets. This illustrates the size of opportunity for a proactive approach to asset management.

The rise of the internet has seen the birth of various websites to meet this growing demand for buying and selling used equipment. However, with many sites simply providing an online portal for buyers to dispose of unwanted items to the highest bidder, few of these add any value to what is often seen as a purely financial transaction. The human touch – which brings with it industry knowledge, expert advice and guidance to both buyer and seller – is sadly lacking.

Best practice in proactive asset management has been developing over the last decade. Specialist service companies staffed by industry experts and proven project management professionals have emerged to become leaders in this new field. They offer an approach and services that are significantly different from the ‘traditional equipment dealer or auctioneer’. As one of the preeminent vendors in this field, EquipNet provides a holistic approach to surplus asset management that balances the needs of both sellers and buyers. This is effectively illustrated using its ‘Value Control Model’ (above).

How have buyers found the purchase and use of second-hand equipment?

Potenza: Terry Geck is founder of Florida-based Stage Coach Sauces LLC, which specializes in bottling pourable food products. The company has been investing in second-hand packaging equipment (Figure 2) in order to upgrade the processes at its facility, increasing throughput by debottlenecking the packaging lines.

“The savings that can be made by investing in used equipment are significant - as much as 20 to 70 percent,” says Geck. “Re-using equipment can transform the economics of a re-tooling or upgrading project, but you need a trustworthy partner to source good kit. They need to know the market and the machinery inside out, and be able to set a deal at the right price for both the seller and buyer.”

“My biggest concern is that you will buy junk. Some of the equipment I have bought has been in the region of $50,000 - a significant sum. So establishing a quality supplier relationship is critical.”

“EquipNet was recommended to me by other companies and their professionalism and quality is now so valuable to us. They have been very good at researching any guarantees available from the vendor and in transferring them through to us. All the equipment we’ve purchased from EquipNet has been of really high quality and worked reliably.”

Sources:

2. http://www.smitherspira.com/news/2013/december/global-packaging-industry-market-growth-to-2018

Next: Advice for machinery sellers and final thoughts

What should a business do when considering selling its unwanted manufacturing or packaging equipment?

Potenza: Surplus machinery can often be adapted for re-use elsewhere, rather than being disposed. Redeployment cannot be successfully and consistently achieved, however, unless there is a central tracking platform installed within all company locations. Users should be able to post, track, identify and internally redeploy equipment that is not being used in its present location ahead of any decision to move to external sale or purchase of additional new items. An established example of best practice in this area is EquipNet’s ARMS (Asset Redeployment Management System) platform. This simple, yet robust program features: workflow management; multiple access levels for plant managers and executives across the business; search functionality and comprehensive listing specifications, providing information that lets the company know exactly what they have and where it’s located.

When redeployment of surplus assets isn’t feasible and a company needs to recoup as much money as possible in a short timeframe, an auction becomes the dependable channel to achieve this goal. Auctions can, therefore, be a very cost-effective route for other businesses to boost their own manufacturing plant with used equipment. But negotiating the auction process – whether buying or selling – is fraught with hazards and success depends on many factors. A specialist partner should advise on the right approach in each case. Options might include online auctions, live/webcast auction events, and sealed bid events. Using a company with specific industry experience combined with a solid reputation is crucial to success.

Where redeployment or resale are not possible, assets that hold very little value are best dealt with through clearance by donations, scrap, and environmental recycling. Companies should consider the scrap value of idle equipment and compare that amount against the market sale value to arrive at a strategy that will generate the highest return. EquipNet routinely advises clients in this area.

What should companies consider when seeking equipment for new facilities or introducing new production lines to support NPD?

Potenza: For companies opening a new facility, second-hand equipment can be a cost-effective way to provide the machinery required, reducing capital expenditure at the outset to deliver a speedy return on overall investment.

Despite the constant introduction of ‘brand new’ products and packaging, closer examination in many instances will reveal it’s often a case of evolution rather than revolution; even if designs and materials change fundamentally, many manufacturing processes are replicated in new packaging, for example a folding or adhesive process in box production. This means that sourcing equipment that has fallen out of use elsewhere – either from another company site or from an external provider, may be a more sensible option than investing in costly new items.

However, purchasing second-hand equipment from an external source can be challenging. Firstly, sourcing the right piece of machinery for the required purpose can be time consuming. Once a potential item has been located online, companies may then face considerable challenges in investigating its provenance, condition and fitness for purpose, and negotiating a suitable price in line with market value. Overcoming the logistics of shipping it to their own facility can be equally hard, particularly for overseas transactions. Buyers must navigate their way through a minefield of international trade agreements, regulatory frameworks, packaging standards and logistics practices.

Many companies lacking the necessary time and resources now look to an outsourced partner. An expert with specialist knowledge of the industry and its equipment and dedicated resources can add considerable value, seeking out suitable equipment and alerting potential buyers when appropriate machinery is available for sale or when there is a relevant auction. Such a partner can also assist with shipping, advising on details such as location, zip code and weight, and providing any available product warranties from the source.

What parting advice do you have for our audience of packaging professionals?

Potenza: Smart companies looking to succeed in today’s competitive international marketplace have integrated asset management into their operations – redeploying assets where they can, turning genuinely surplus equipment into cash, and maximizing the cost-saving potential of second-hand equipment purchases as they develop and grow. However, as we have seen, the asset management process is complex and many managers are choosing to work with a specialist partner that can add value by advising on every aspect of buying and selling used equipment.

In the packaging sector, where ambitious growth targets and NPD are allied to tough efficiency and sustainability goals, a reliable partner with industry knowledge can be critical to success, ensuring operational efficiency and delivering a major positive impact on a company’s bottom line.

Ben Potenza is vp of marketing at EquipNet, having joined the company as the second overall employee in 1999. In this role, he oversees a world-class, global marketing team that plans and executes all of their inbound and outbound marketing activities.

5 Dan Road, Canton, MA 02021

Tel: 781-821.3482

Fax: 617-671-1269

About the Author(s)

You May Also Like