Demand chain investment key to CPG growth

January 30, 2014

Top-performing companies in the food, beverage and household products sectors who leverage the demand chain will be in the best position to continue to grow according to the 2012 Financial Performance Report by the Grocery Manufacturers Assn. (GMA) and PwC, titled "Profitable Growth: Driving the Demand Chain."

In 2011, both *top and bottom performing companies saw their sales growth continue to revive. The food, beverage and household products sectors each showed continued strong net sales growth of 9.5 percent, 10.5 percent and 7.5 percent respectively.

According to the report, CPG companies and retailers should invest in brands by leveraging the demand chain to better identify and meet consumer demand. The links in a typical CPG demand chain might include front-end sales, marketing, customer service, trade promotions, brick-and-mortar retail partners, online retailers, social media sites and reverse logistics or end-of-product-life recycling. The report includes a breakdown of the CPG sector's top-performing companies, explores direct-to-consumer touch points, consumer demand for sustainable product and overseas expansion as a way to fuel future growth.

"Perhaps more so than in any other sector, CPG companies constantly monitor the temperature of the consumer," says GMA president/CEO Pamela Bailey. "Consumer demand moves so fast, only those with fast, nimble and cost-effective supply and demand chains will be able to keep pace."

"CPG companies who shift new strategic investments to their demand chain will stand the best chance of creating new growth," says Susan McPartlin, PwC's U.S. leader, retail and consumer industry. "The series of activities that sparks and maintains a brand—the demand chain—should be just as integral a part of strategic decisions as are operations and the supply chain."

Now in its 16th year, the GMA-PwC Financial Performance Report includes analyses based on public information from 142 companies in the food, beverage and consumer products sectors as well as 67 retailers.

Among the key findings:

•Investment in brands and in long-term positioning remains a significant predictor of performance and is critical to effective demand chain management.

•For the first time since 2008, the bottom performing group enjoyed higher net sales growth.

•Some top performers expanded sustainability initiatives with an eye towards cutting costs while driving growth by building consumer interest in socially and environmentally responsible product.

•Retailers have a slightly better performance than manufacturers with regard to shareholder returns: 10.3 percent vs 8.7 percent.

•Over the past five years, top performing companies have spent more on defending their market share than bottom performing companies, as measured by strategic median selling, general and administrative (SG&A) spending relative to sales.

•Strong liquidity continues to give top performing companies more options to invest in R&D, innovation and acquisitions.

•Many top performers have continued to invest heavily in emerging markets, with the goal of building trust among consumers.

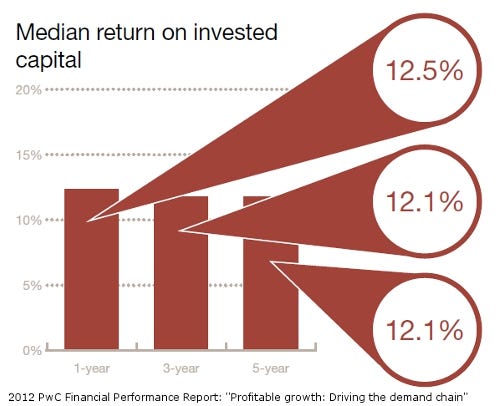

PwC Profitable Growth chart

According to the report, exports from CPG companies continue to rise as international markets present greater growth opportunities. Emerging markets remain the most promising source of economic growth as the expanding middle class consumes more, with U.S. exports of CPG products to the largest emerging nation purchasers (China/Hong Kong, Taiwan, South Korea, and the Philippines) almost tripling between 2005 and 2011, from $5 billion to $13 billion. Between 2005 and 2011, total exports of CPG products essentially doubled, from $40.3 billion to $80.3 billion. The $40 billion increase was split evenly between traditional export markets (the European Union, Canada, Japan, and Mexico increased from $26 billion to $46 billion) and emerging economies (which increased from $14 billion to $34 billion).

"There have been positive economic developments over the past year that paint a more promising picture. But for CPG companies, market risks persist and they need to stay nimble, informed and be adaptive in a higher-risk environment that brings unanticipated events," adds Lisa Feigen Dugal, PwC's North American advisory leader, retail and consumer industry. "Three factors that CPG executives need to consider include continued commodity price volatility, how emerging markets—despite the growth opportunities—bring the uncertainties of developing economies, and the fact that new government policies could represent fundamental changes to the tax, regulatory and operating environment.

"Profitable Growth: Driving the Demand Chain" will be presented via webcast by PwC and GMA on Monday, June 25, at 1:30 p.m. EDT (click here for registration information).

For an electronic copy of the complete report, click here.

*A quartile analysis based on three fundamental metrics: economic profit spread (based on return on invested capital and the weighted average cost of capital); return on assets; free cash flow relative to sales.

Source: PwC

.

About the Author(s)

You May Also Like