RFID in 2006: A story of extremes

January 30, 2014

In some circumstances, RFID tagging of pallets and cases has already improved margins by as much as $100 million for major Western retailers using less than 400 million pallets and cases over two years.

The pallet/case market for RFID tags saw some reluctant mandated customers, technical problems and pricing that never came, despite retailer reports of excellent paybacks.

At the beginning of 2006, there was much optimism in the retail mandate sector. Radio frequency identification tag production capacities had been put into place and Gen 2 was delivering superior performance to previous versions. However, arguably the pallet/case market for RFID tags became the nearest thing to a black hole in the RFID universe in 2006, thanks to reluctant mandated customers, technical problems and pricing for volumes that never came, despite retailer reports of excellent paybacks.

Based on findings from many consumer goods manufacturers, IDTechEx, provider of the industry report, has found considerable foot dragging, resulting in pallet/case tag purchases as low as 250- to 300 million tags in 2006 at the heavily loss-making price of 10 to 15 cents each. RFID tag readers are also being sold at a heavy loss. But some participants have seen benefits. Procter & Gamble found that tagging display cases for Wal-Mart with shared information led to a 19-percent sales increase of [Gillette] Fusion [razor] blades, which was caused by more timely arrival at-shelf. Hanna Candle Co. found that 90 pallets worth $12.6 million went missing but were found through their RFID tags, reducing a "knock-on effect" for ordering. However, these benefits aren't necessarily paybacks, and companies are not saying they are sustainable.

These sums of money are among the smallest of any RFID sector, even less than esoteric niches like one company tagging random samples of mail to assess performance or another company earning from tagging cows. The point is that the mail tags cost $10 or more and the cow tags cost $2. Both of these companies have around $50 million of probably profitable sales. One could go on and on with examples like this.

Read about how CINGULAR WIRELESS' RFID smart labels and auto print/apply system improve warehouse and material-handling operations at www.packagingdigest.com/info/ Cingular

RFID hardware suppliers that had prioritized the retail sector started to look elsewhere, though none left the sector altogether because they know there will be a winner one day, and most have strong backing. They seem to be playing "Last One Standing." There is an oversupply, although some system integrators are making money.

Basically, the RFID tagging of pallets and cases has already improved margins by as much as $100 million for major Western retailers using less than 400 million pallets and cases over two years. This was provided at a loss of about $100 million by the consumer product goods (CPG) companies that supply them. In addition, the RFID suppliers to the CPG companies also lost about $100 million in the exercise. In the case of the RFID suppliers, that money came from investors and parent companies. It was certainly not predicted that those investments in RFID companies would, in effect, flow rapidly to the large retailers. System integrators are faring better, with some even claiming to make money installing a pallet/case RFID infrastructure at CPG companies and at retailers. At least with the anti-theft tags earlier mandated by retailers, the tag and system suppliers to the mandated CPG companies stayed profitable because they didn't price for volumes that never came. However, anti-theft tags did and still do cost the CPG companies heavily, for no return. So the pallet/case RFID is history repeating itself.

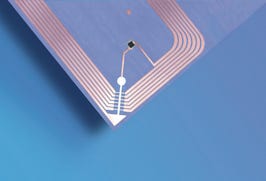

Although we forecast that eventually, the retail sector will be the biggest market by far for RFID, CPG companies have yet to see sustainable paybacks. The real opportunity for them is with item-level tagging. Retail mandates asked for the companies' top suppliers to tag the pallets and cases of the highest-volume products they sell. The highest-volume products tend to be those that are of lower value and of lower margin, and therefore it comes as no surprise that most consumer goods suppliers don't get a payback. For RFID suppliers, item-level tagging for retailers is a better business in which high-value products, such as Marks & Spencer apparel and Best Buy video games, are tagged first. However, this is vulnerable to rapid design change. Like anti-theft tags, there are three incompatible options here—Near Field UHF, Far Field UHF and HF.

Hot countries for RFID

IDTechEx keeps a close eye on which countries are eagerly adopting RFID and which are not. Its sources include intensive travel, conferences, literature searches and its RFID Knowledgebase (www.rfidbase.com) of more than 2,400 case studies covering more than 2,600 organizations and 91 countries. The results are rather surprising.

Eventually, retail will be the biggest RFID market, though consumer companies have yet to see sustainable paybacks.

First, the U.S. is the greatest adopter, with by far the largest number of cases of RFID in action and orders that are often the world's largest by value. It has even pulled ahead in the last year, with more than 840 recorded projects. More surprising is that the U.K. holds second place by number of cases, though not the money spent, an area in which China has more claim to fame and in which Korea and Japan are strong rivals.

China and Korea have jumped up a notch and, remarkably, Australia has jumped from number 10 to number seven. When IDTechEx saw the unusual activity in Australia, it focused research onto the region for a new report entitled "RFID in Australasia 2007-2017," and reveals some of the results here. New Zealand is a follower, with the exception of the work of Fonterra, the world's largest milk cooperative.

What's going on in Australia? The rapid advance of Australia in RFID is on a broad front, from books in libraries to tagging of humans in hospitals, but one could say that about many countries. What sets Australia apart from most of its peers are aspects such as the legal requirement to tag cattle and racehorses, and the trials and rollouts of tagging fish, tomatoes and other foods by its vibrant food industry. Australia will not stop there. It's likely to introduce legislation to tag all four-legged livestock ahead of most other countries. With the major trading blocks finding reasons to protect their food industries, external suppliers such as Australia, with the world's largest population of sheep, must be beyond suspicion. RFID is a part of that.

RFID sectors taking off

Beyond packaging-related applications, other sectors of the RFID business are booming. Andrew Price, RFID manager at the International Air Transport Association (IATA) enthuses, "In the next few years, the [airline] industry will be tagging an ever higher proportion of its two billion bags yearly and it will use RFID in other new applications as well." This is a global phenomenon, not to mention government applications. Dr Jimmy Li, deputy director of the Initiative Office for Government RFID Applications at the Ministry of Economic Affairs Taiwan and senior advisor of the Institute for Information Industry in Taiwan says, "Government applications of RFID are now growing rapidly. We started five RFID projects in the government area this year and there are more to come next year."

In addition to considerable growth in the transportation area, the aerospace and defense industries are on a rapid RFID adoption path, according to Steve Georgevitch, total asset visibility program manager of Boeing Integrated Defense Systems. Dr Chang-Hun Lee of the National Information Society Agency, Korea, says, "Ubiquitous Sensor Networks will be a huge RFID market in a few years."

RFID tagging of livestock is driven by ever-wider legislation. For example, the European Community and New Zealand join the party in 2008 to 2010, creating a market for tagging sheep, goats, pigs and cows, the total demand for these two regions being over 150 million tags yearly at about $2 each in 2010 from almost none today. Add a big demand for systems to that figure. The largest book seller in the Netherlands, BGN, is ordering several million tags yearly for its new scheme and its payback is so compelling that others will rapidly follow.

RFID cards top the market by value

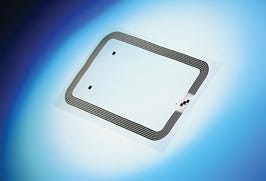

When it comes to the biggest RFID market—contactless smart cards—Don Davis, editor of Card Technology, says, "Big players are making major bets on contactless and are forcing competitors to catch up. They are issuing large numbers of contactless cards and fobs and, in Japan, adding contactless functionality to millions of mobile phones, giving many consumers the chance to pay with a wave."

Sectors such as transportation, aerospace, livestock, bookselling, bank cards, mobile phones and more are booming with RFID.

Contactless cards are a huge success and contactless ticket sales are also taking off exponentially. The China National ID card system is the biggest RFID rollout, but an even larger budget of at least $15 billion is being planned for the U.K. National ID card. Then, there is continued growth in secure-access applications and the start of the process of converting more than 3 billion financial cards from Visa, MasterCard, American Express and more to RFID. In the U.S. alone, 150,000 readers have been installed for these cards. That's only the beginning.

Author Raghu Das is the CEO of IDTechEx. Experts he quotes in this summary article will be presenters at the sixth annual RFID Smart Labels USA and Active RFID & RTLS conference in Boston, Feb. 21 to 22, an event that will analyze and detail the status of EPC and other RFID markets with critical business strategy information To obtain the full study summarized here on RFID Forecasts, Players & Opportunities 2007-2017, visit www.idtechex.com/usa.

You May Also Like