Is Your Package Shipping Operation Prepared for a UPS Strike?

Shipping executive breaks down the tense situation of a possible UPS package handling strike and tells the best way forward for packaging operations.

Negotiations failed between United Parcel Service and the Teamsters representing the company’s package handlers, loaders, and drivers on July 5. With the looming deadline of the end of this month to agree on a deal, we are faced with the possibility of a crippling strike. UPS holds nearly a quarter of the market share for package shipments in America for business-to-consumer (B2C) and business-to-business (B2B) commerce.

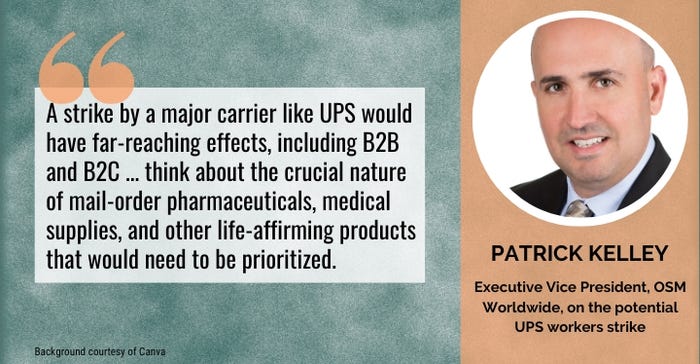

We asked Patrick Kelley, Executive Vice President of OSM Worldwide, to explain what’s likely to happen and offer ideas on how to mitigate the pain for product manufacturers that ship via the small-parcel environment.

What is the possibility that this strike will happen?

Kelley: It’s really hard to pinpoint, and all comes down to both parties coming to an agreement in time, but everything we’re reading on the progress of those conversations says the Union is very specific in what they want, and the carrier will have a hard time giving on everything. It’s a tense situation.

Does this impact ecommerce shipments only, or what?

Kelley: A strike by a major carrier like UPS would have far-reaching effects, including B2B and B2C (which includes direct-to-consumer and ecommerce shipments). Retail apparel and other CPG [consumer packaged goods] items, even some Amazon shipments will be affected; and think about the crucial nature of mail-order pharmaceuticals, medical supplies, and other life-affirming products that would need to be prioritized.

UPS currently has 24% of the market for shipments. If there is a strike, how much of that business will be in jeopardy? All of it?

Kelley: UPS is second in parcel volume behind USPS (and just ahead of Amazon), there’s a lot of business in that equation. We need to break it down between short-term and long-term effects of the strike, and it honestly depends on the decisions of the shipper both now and later.

More immediately, UPS may be able to move some existing volume over to its USPS last-mile delivery option, which could help ease some of the pressure. In the long run, the uncertainty may cause some shippers to lose some faith — when is the next time an outage might affect our shipments again? The whole situation is driving a more serious look at multi-carrier strategy among shippers of all sizes.

Do you think the federal government will intervene? Why or why not?

Kelley: When we consider the gravity of a strike and the resulting disruptions to supply chains, intervention is almost critical. We’ve seen the federal government get involved in recent disputes, but the situations (and their power/ability to affect change) were weighted differently. It might be a question of “how bad do things get?” before we know how much intervention will be attempted or required.

If there is a strike, what are the likely scenarios and how will those impact package delivery to consumers and businesses?

Kelley: Suffice it to say, if a strike does happen, no one carrier can handle nearly a quarter of the overall domestic parcel volume alone, and the entire industry is going to have to collaborate. We’re already seeing reports from competing big-three carriers relative to volume planning, and there’s no guaranteed acceptance into their networks — there will be limitations on what new volumes are taken on to continue providing a high level of service for existing customers.

I mentioned earlier UPS could move some volume over to its existing USPS last-mile delivery program as a means of alleviating some pressure. It might also look to past strike and stoppage experience and tap non-union managerial staff within its network to handle some (but not nearly all) of the delivery responsibilities. Overall, the collaboration of carriers and consolidators will need to focus first on priority items for most-affected customers — the aforementioned pharma, medical, and life-affirming item shipments.

What should people in our audience do about this and why?

Kelley: Some shippers have taken a “wait and see” approach to this news, while others have moved quickly toward adopting or revising their multi-carrier strategy, which offers benefits beyond the clear and present issue of reliability (cost savings, regionalization, and others).

Multi-carrier strategy has become the most sound business practice not just for thwarting challenges like the one we’re up against now, but for everyday operational efficiencies as well.

About the Author(s)

You May Also Like