Making Sustainable, Circular Packaging a Profitable Reality

Look inside the numbers: A shift to sustainable packaging turns out to be good business.

The planet reached an ominous milestone in 2020, when, according to the Weizmann Institute of Science, the weight of the world’s plastics doubled that of its marine and terrestrial animals. Just as ominously, the Global Plastic Action Partnership recently reported that an estimated 11 million tons of plastic now enter the ocean annually.

In Europe alone, where packaging waste increased more than 20% over the last decade and would likely grow by a similar amount by 2030 if left unchecked, the European Commission, along with various individual jurisdictions, are implementing policies to try to reverse these trends. Newly proposed EU-wide rules on packaging, for example, aim to curb waste, boost reuse and refill, and foster circular packaging approaches.

For the consumer packaged goods (CPG) industry, developments like these continue to amplify a clear message from government policymakers, scientific researchers, shareholders, and consumers: Shift to sustainable packaging or risk paying higher taxes, tarnishing brand reputation, and losing market share.

For CPG companies, committing to such a shift isn’t just another compliance cost to bear, it turns out to be good business. In a recent analysis of US consumer products sales data from 600,000 individual stock-keeping units (SKUs) across 32 food, beverage, personal-care, and household categories, McKinsey and NielsenIQ found that products with claims related to Environmental, Social, and Governance (ESG) printed on their packaging held a 1.7% advantage in compound annual growth over products without them.

Figures like these suggest there’s a golden opportunity for CPG companies to profit by moving away from the take-make-waste linear consumption model, to more sustainable, circular packaging processes and materials. To do so, they’ll need to have these four cornerstones in place:

1. A mastery of data.

To meet internal sustainability targets and comply with extended producer responsibility (EPR) laws and other policies, CPG companies must be able to collect, analyze, and accurately report data showing the make-up, origin, and carbon footprint of the materials they use and the products they make across the entire product lifecycle. They need to be able to collect and standardize data not only internally, but also from other entities in the value chain, then provide that data to meet reporting requirements, which can differ significantly across jurisdictions.

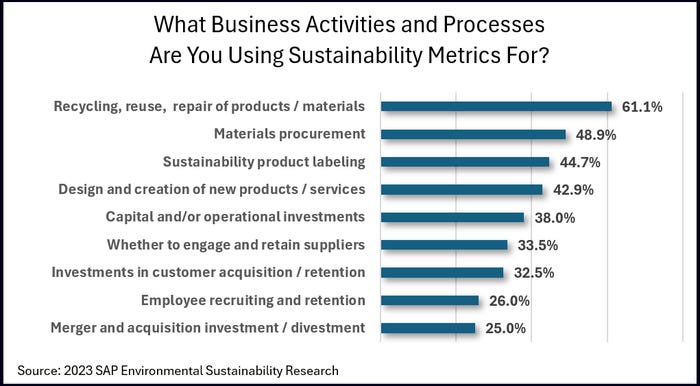

Armed with insight from the data they collect, companies can make better informed decisions based on resource consumption and carbon footprint calculations, with the ability to evaluate their own products, as well as suppliers’ products, based on sustainability performance. How does one packaging supplier compare to others in their use of recycled content, for example?

CPG companies must be able to answer questions like these in a world where the sustainability performance of one segment in the supply chain can impact all the other segments in that chain. All this is predicated on companies’ willingness and ability to share trusted data. Digitally connected business networks can provide the framework for doing so.

2. Current with policy developments and compliance.

As of January 1, 2023, a tax on non-reusable plastic packaging took hold in Spain, one of more than 4,400 new EPR regulations that popped up globally in the last quarter, according to an EY regulatory monitoring tool. There is indeed much for CPG companies to keep track of — and stay compliant with — in the markets in which they are active.

That’s a much simpler task with software that tracks EPR policies and other policy developments across the globe, and that helps manage fees, taxes, penalties, and such, in specific jurisdictions, ensuring all packaging specifications that apply to a CPG company are up to date to calculate their exposure.

3. Advanced design capabilities.

Rather than reckoning with waste on the back end of the product lifecycle, with all the added costs that involves, CPG companies are using design to address resource footprint in the planning phase. Because, while research and development accounts for just 5% of the total cost of a product, it influences up to 80% of its resource footprint.

While research and development accounts for just 5% of the total cost of a product, it influences up to 80% of its resource footprint.

With advanced modeling tools, companies can analyze how specific design trade-offs (involving alternative materials or feedstocks, for example) impact cost, margin, recyclability, EPR exposure, carbon footprint, and other factors — so they gain a clear line of sight into the relationship between sustainability choices and business success.

A CPG company’s design approach actually can change consumer habits at a mass scalable level. Unilever, for example, has collaborated with designers at Accenture Industrial Design Services (formerly the Van Berol agency) to create Dove refillable, reusable deodorant.

4. Open to explore alternate materials and business models.

Swiss running shoe company On recently launched a circular shoe-by-subscription service, where it washes and grinds down the material from returned shoes to use in the production of new ones. Meanwhile, the Unless collective has created a sneaker entirely from 100% natural materials, including Mirum, a plastic-free plant-based leather alternative, and Clarus, a high-performance recycled cotton. It also offers a free takeback program where it takes the “grinds” from used shoes to create new soil products.

Other CPG companies are exploring pay-as-you-use and refillable container business models. The new Algramo app, for example, enables consumers to purchase their favorite products in reusable packaging.

One reason we’re hearing more about companies like these is because they’re not afraid to tout their products and services to a consuming public that increasingly values brands that back up their sustainability commitments with action.

“To build trust with Gen Z consumers, businesses must be transparent about their sustainability journey and what action they’re taking to improve circularity. This should be weaved into all marketing collateral, from pre-purchase through to on-pack messaging.”

As Nick Beighton, former CEO of online retailer ASOS, pointed out in comments accompanying a 2022 report from Duo, “To build trust with Gen Z consumers, businesses must be transparent about their sustainability journey and what action they’re taking to improve circularity. This should be weaved into all marketing collateral, from pre-purchase through to on-pack messaging.”

About the Author(s)

You May Also Like