How can mid-sized food suppliers deliver circular packaging solutions?

November 15, 2019

New research will analyze challenges and comparisons of companies in the Netherlands versus California, two hotbeds of environmental interest and responsibility.

People working in jobs related to producing, packaging, distributing and selling food products face increased sustainability demands. Such demands evolved over the past 50 years, starting in the 1970s (1). Current interest in sustainability remains high amongst packaging professionals as such articles are commonly read the most often in industry trade journals such as Packaging Digest (2).

Between North America and Europe today, there are 47 standards related to the sustainability of processed foods (3). While sustainable food production and packaging are similar to the notions of circular food production and circular packaging, they are not the same. Many publications over the past few years have compared the two types of practices, with a good summary given by Korhonen (4). It’s unfortunate that in the past century we have foregone our previous sustainable and sometime circular lifestyles that were common for hundreds of years in the past (5).

Sustainable packaging design focuses on developing eco-friendly designs and production strategies. Such practices tend to be linear and do not address imbalances between input and output streams, nor address the quality of recycling well.

Many sustainable packaging programs focus on material reduction, which sometimes results in complex materials such as (plastic) laminates. Such inseparable material combinations hinder the development of products and packaging for circular systems (6).

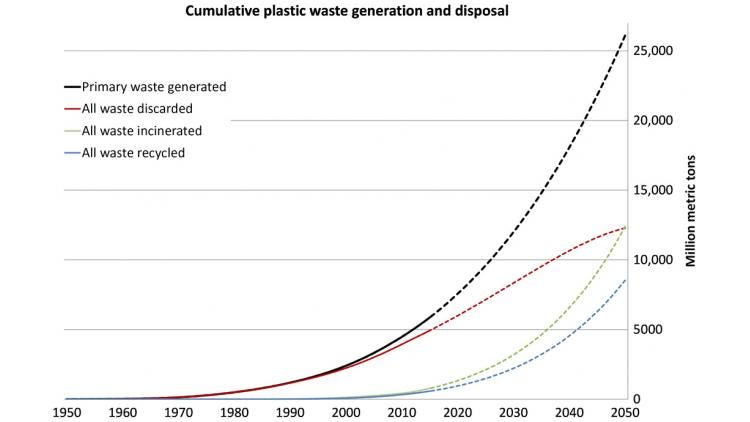

In countries in the Organisation for Economic Co-operation and Development (OECD), plastic package recycling rates vary between 10% for the USA to 50% for the Netherlands. The net result of this deficiency is a growing waste problem as shown in Figure 1.

A new motivation for circular plastics packaging stems from China and other Asian countries deciding to stop accepting and “processing” plastic waste from around the world. In fact, these policy changes from Asia have had a negative effect on plastics collections and recycling in many European and North American communities (7) (8).

Figure 1: Cumulative plastic waste generation and disposal (in millions of metric tons). Solid line shown historical data from 1950 to 2015; dashed lines show projections of historical trends to 2050. (Reprinted from Science Advances 19 Jul 2017: Vol. 3, no. 7, e1700782 DOI: 10.1126/sciadv.1700782. Copyright The Authors, some rights reserved; exclusive licensee American Assn. for the Advancement of Science. Distributed under a Creative Commons Attribution Non-Commercial License 4.0 (CC BY-NC) http://creativecommons.org/licenses/by-nc/4.0/).

Currently, literature focuses on the theoretical implications of transition to circular systems, while practical examples of packaging concepts suited for circular systems are scarce (6). For example, reusable packaging is a circular concept that is still rarely implemented by food producing companies and value chains. But TerraCycle is carrying out some ambitious trials currently with some multi-national brand owners (9) (10).

This is not to say that leading circular design practices are not being taught at the universities that we are involved with—such as California Polytechnic University San Luis Obisbo, and the Dutch Technical Universities of Twente and Delft.

Further, most research and pilot projects about circular packaging solutions focus on the world’s largest food brand owners, with small- and medium-sized enterprises under-researched (6) (11). These larger companies control about 80% of the processed foods that appear on the shelves of typical grocery stores in North America and Europe (12).

____________________________________________________________________________________________

WestPack 2020: Ideas. Education. New Partners. Feb. 11-13

WestPack 2020: Ideas. Education. New Partners. Feb. 11-13

____________________________________________________________________________________________

Recently, there has been some motivational economic case studies about larger volume business-to-business (B2B) circular packaging solutions by the Reusable Packaging Assn. (13) and the Reusable Industrial Packaging Assn. (14). Thus, we are focusing our research on mid-sized companies in the food production chain, about which little work has been done.

We will focus our research geographically to California and the Netherlands. You may ask why.

First, California and the Netherlands both actively strive to enact and implement leading environmentally friendly policies and practices related to food production and packaging (see “History and current initiatives”below). The ambitions are leading compared to peers.

Second, both of these areas are world agriculture and food production powerhouses, with California the leading state in the USA, and the Netherlands the leading agriculture exporter in the European Union (15) (16). Thus, these two areas provide a rich ecosystem for our research efforts.

Both the Netherlands and California promote, or are starting to mandate, sustainable and circular packaging solutions for all industries including food.

Thus, by carrying out parallel studies in both areas, we can learn from each other when it comes to which factors are most and least important for realizing successful circular packaging solutions. Successful circular food packaging solutions require alignment and cooperation of numerous stakeholders, as discussed below. Solutions cannot be designed, implemented and rolled out in a vacuum.

Three drivers of circular food packaging

From our perspective, in Figure 2, we identify three issues that need further research to put out pilot projects related to circular food packaging in both countries.

The past few years, several organizations either surveyed or wrote about consumers’ behavior related to “sustainable” products or reusable packaging of branded products (including food) (17) (18). However, these surveys are not specific enough when it comes to identifying actual consumer behavior and needs of reusable food packaging solutions on a daily or weekly basis.

Further, retail grocery stores and foodservice providers will not facilitate most circular food packaging initiatives unless there is evidence of strong consumer buy-in over longer periods of time.

Figure 2: Drivers of Circular Food Packaging

Even if consumers are willing to change their behavior relative to circular-friendly packaging, economically it needs to make sense for all parties involved in the supply chain. Economic gain is difficult to substantiate and is a topic widely research and written about. Understanding the value propositions of certain kinds of circular practices can be difficult for traditional investors and banks (19).

In the Netherlands, the three biggest banks launched guidelines in 2018 for creating a common framework for financing circular economy initiatives by industry (20). Thus, there is some movement by the financial community to address the economic viability of new initiatives. However, most likely most actual projects will have to be financed by individual companies in the value chains, with perhaps consumers having to pay more for their packaged food product(s) as well.

Lastly, we need to consider the closed-loop environment impact of any new circular packaging solutions. The solution may be wanted and acceptable to consumers, and it may be profitable for the delivery value chain, but the environmental impact also needs careful consideration.

The problem with life-cycle assessment (LCA) for our research is the lack of agreement on the proper frameworks to use in carrying out the analysis (21). There are numerous frameworks and tools like COMPASS for carrying out LCA. Any LCA needs to also consider food waste, and how the results can be communicated to consumers and members of the value chain to convince them to cooperate in new initiatives.

Current research focus and ambitions

Our research in the Netherlands and California will focus on the following four research topic in the next two years:

1. Consumers:

• Characterize consumer behavior/needs toward specific circular packaged food products in the Netherlands and California.

• Understand consumer attitudes towards reuse, co-use or refill offerings of specific foods.

2. Mid-sized Food Producers:

• Identify appropriate mid-sized food suppliers and their value chains that are ripe for moving forward with circular food packaging initiatives.

• Inventory the needs of mid-sized food producers with regard to circular economy ambitions.

• Determine operational needs and technical requirements from the food producer to consumer.

3. Retail Grocery / Foodservice Value Chains:

• Characterize economic needs and costs from the retail perspective.

• Inventory needs of downstream members of value chain concerning distribution and reverse logistics issues related to reuse, refill, co-use, re-appropriate or recycling.

4. LCA, Economics and Pilot Project(s):

• Propose a circular model for one or more food products in California and the Netherlands (including economics, costs, investments needed, life cycle assessment).

• Establish a consortium of companies in the Netherlands and California willing to carry out a pilot project for the circular model proposed.

�• Measure consumer behavior to the new circularly packaged food compared to non-circularly packaged food.

• Characterize and pursue additional sources of funding for implementing the pilot project for the consortium of companies.

• Learn from comparisons and contrasts between the Netherlands and California.

We intend to publish the results of research topics one to three in the first half of 2020 in Packaging Digest. Depending upon consumer cooperation, we intend to further publish the results of our field trials at the end of 2020.

At this time, we are looking for mid-sized (fresh) food producers, retail grocery chains, logistics service providers, and packaging companies in California and Northwest Europe to join our research and pilot project efforts in 2020. Interested companies in these areas can contact us via this form.

____________________________________________________________________________________________

WestPack 2020: Ideas. Education. New Partners. Feb. 11-13

WestPack 2020: Ideas. Education. New Partners. Feb. 11-13

____________________________________________________________________________________________

History and current initiatives

In past centuries, most products were recycled or reused, as there was perpetual scarcity of food and packaging materials (5). Thus, recycling focused beyond metal, paperboard and glass, to include porcelain/clay jars, cotton bags and wooden boxes amongst other packaging materials.

Over the past 100 years, in most countries of the world, food scarcity subsided, and efficient industrial production created mass-produced raw materials and packages for food production and distribution. During the 20th century, plastic packaging was also introduced into the food supply chain. The net result of this has been less food waste, more consumer choice and convenience, longer supply chains, and much lower prices for food.

As packaging pollution increases worldwide, numerous government and non-profit organizations are implementing laws and initiatives to turn the tide against simple linear production of food. Recent Extended Product Responsibility (ERP) policies extend a manufacturer’s responsibility for reducing packaging impacts downstream, when consumers are done with them (22) (23). Over the past 30 years, more than 300 ERP laws have been passed and implemented in both the European Union and in the USA, with a good overview provided by CalRecycle (24) and OECD (25). Of these laws, only 17% of them are related to actual packaging.

The OECD reports that in the European Union recycling rates of packaging vary between 29% and 84% in 2014, with a target of 55% for all plastic waste by 2025. In 2016, in the European Union, recycling of plastic packaging reached a level of 40.8% and, for the first time, recycling rates exceeded energy recovery and landfill rates (26). Collection of plastic packaging in the Netherlands is higher, close to 50% in 2019 (27), but unfortunately only 35% of the collected waste ends up being recycled into new plastic, resulting in a yield of only 17%.

There are several reasons for such a low yield, which are beyond the scope of this article. But some of the main limitations behind using recycled plastics for food are:

• Food safety requirements for recycled plastics used for food (28) (29).

• Competition in undifferentiated markets for recycled plastic versus virgin plastics (30).

• Many new virgin plastics production plants coming online driven by cheap natural gas prices, resulting in cheap virgin materials (31).

Now let’s look at specific initiative and activities in California and the Netherlands.

Recently, in California, a new Senate Bill (SB-54) called California Circular Economy and Plastic Pollution Reduction Act is going through committee processes (32). The goal of this law is to achieve 75% recycling rates by 2030, and to reduce single-use packaging by 75%. Currently, in California less than 9% of plastic is recycled.

Historically, California has depended on exporting plastics and paper packaging streams to China and other countries—which is no longer possible. It’s noteworthy that about 75 organizations in and outside the state support the new bill, while seven major organizations—including the Grocery Manufacturers Assn., Plastics Industry Assn. and Household and Commercial Products Assn.—oppose the new bill.

A longer campaign has existed to educate California consumers and small- and medium-sized businesses about reusables for food products and food production. The Use Reusables campaign is a joint project of Alameda County (CA) public agency and the Reusable Packaging Assn. (RPA). Launched in 2007, the campaign’s goal is to help businesses and institutions assess and optimize the transport packaging materials and systems they use, either within their manufacturing process or for product distribution (33). Thus far, the focus has been on totes, crates, intermediate bulk containers and reusable strapping to secure bundled bulk pallets of products in business-to-business (B2B) closed-loop deliveries.

In the Netherlands, the government launched the program A Circular Economy in the Netherlands by 2050 in September 2016. In this program, a nationwide plan is drawn up by multiple ministries to function as a vision for the successful implementation of the circular economy. The goal formulated in this report is to reduce the amount of primary resources used in the Netherlands by 50% in 2030, and to become completely circular by 2050 (34). In addition, the government facilitated the creation and support of the website Holland Circular Hotspot. It is a private public platform in which companies, knowledge institutes and (local) authorities collaborate internationally to exchange knowledge and stimulate entrepreneurship in the field of circular economy (35).

In 2014, as part of the Dutch government’s efforts to ramp up extended producer responsibility of packaging, the “Packaging Waste Fund” was established by producers and importers. This fund’s purpose is to collectively meet the extended producer responsibilities as stated in the national Packaging Decree and Packaging Agreement between industry and the government. It is a not-for-profit organization governed by a board of directors, who are themselves appointed by producers and importers (36).

Thus, as of 2018, all producers and importers of end-user consumer packaged products must pay levies into the waste fund, which vary between 2 and 78 euro-cents per kilogram (Note: B2B logistics packaging is not included) (37). Manufacturers packaging consumer products can qualify for lower levies if they agree to use a certain percentage of recycled content in their packages. Thus, economic incentives are being created to use recycled streams of materials. This organization reports that, in 2017, the Dutch recycled 87% of paper and paperboard, 86% glass, 95% metal, 73% wood and 50% plastic.

The Packaging Waste Fund resulted in the creation of the Netherlands Institute for Sustainable Packaging (KIDV), which is funded for 10 years at 2M euros per year by the fund. The KIDV employs a staff of 16 and acts as a national clearing house for developing, sharing and bringing knowledge together in the form of events, collaborative research, tools and expert advice (38). The KIDV is similar to the non-profit member-supported American Sustainable Packaging Coalition, which has been active since 2004.

A lot of the KIDV’s current activities focus on plastics, as the Netherlands already recycles a majority of non-plastics. For example, last July, they initiated a Community of Practice (CoP) with a consortium of companies facing similar challenges related to developing metallized flexible packaging that is suitable for the circular economy (39). The government decided that one of the five focus areas of its circular economy initiatives should focus on plastics.

In private industry, in February 2019, Dutch Grocery Store Organization made up of 24 corporate members agreed to reducing all packaging in their retail stores by 20% by 2025 (40). Initial efforts will focus on fruits and vegetables and on increasing recycled content of packaging. Another organization, MVO (Dutch Foundation for Socially Responsible Entrepreneurship) is also working on facilitating circular economy projects and matchmaking between companies. Their Future Proof Community website has more than 3,500 companies and acts as a matchmaker for companies that put out sustainable or circular challenges and companies suggesting solutions (41).

REFERENCES

1. Kidd, Charles V. The evolution of sustainability. J Agric Environ Ethics, Kluwer Academic Publishers, 1992. Vol. 1.

2. Lingle, Rick. Packaging Digest, Jul. 15, 2019. Sustainability drives the top five in food and beverage packaging.

3. International Trade Centre. Sustainability Map. All processed foods in Europe and North America.

4. Jouni Korhonena, Cali Nuurb, Andreas Feldmann, Seyoum Eshetu Birkiea. Circular economy as an essentially contested concept. Journal of Cleaner Production, Elsivier, Feb. 25, 2018. Vol. 175.

5. Trentmann, Frank. Empire of Things. Penquin Random House UK Books, 2016, pp. 624-654.

6. Bjorn de Koeijer, Renee Wever, Jorg Henseler. Realizing Product-Packaging Combinations in Circular Systems: Shaping the Research Agenda. 2017, Vol. 30.

7. Katz, Cheryl. Piling Up: How China's Ban on Importing Waste Has Stalled Global Recycling. Yale University, Yale School of Forrestry & Environmental Studies, Mar. 7, 2019.

8. Erin McCormick, Charlotte Simmonds, Jessica Glenza, Katharine Gammon. Americans' plastic recycling is dumped in landfills, investigation shows. The Guardian. Jun. 21, 2019.

9. Makower, Joel. Loop’s launch brings reusable packaging to the world’s biggest brands. GreenBiz Group, Jan. 24, 2019.

10. Devenyns, Jessi. Why reuseable food packaging has a promising future. FoodDive, Jun. 25, 2019.

11. Szaky, Tom. The Future of Packaging. Oakland: Berrett-Koehler Publishsers Inc., 2019.

12. Kramer, Anna. These 10 companies make a lot of the food we buy. Here’s how we made them better. Oxfam. [Online] Dec. 10, 2014. [Cited: Jul. 25, 2019.] https://www.oxfamamerica.org/explore/stories/these-10-companies-make-a-lot-of-the-food-we-buy-heres-how-we-made-them-better/.

13. Reusable Packaging Assn. A cost comparison model for reusable transport packaging. 102, June 2016.

14. Studies and Report. Reusable Industrial Packaging Assn. [Online] Aug. 18, 2019. [Cited: Aug. 18, 2019.] https://www.reusablepackaging.org/studies-and-reports/.

15. National Geographic. Tiny Country Feeds the World. September 2017.

16. California Department of Food and Agriculture. California Agricultural Production Statistics. 2017.

17. Wharton University of Pennsylvania. Reusable Packaging from Big Brands: Will Consumers Buy In? Wharton Business School, Knowledge@Wharton, Feb. 12, 2019.

18. Nielson. Consumer-Goods’ Brands That Demonstrate Commitment To Sustainability Outperform Those That Don’t. [Webpage]. Oct. 12, 2015.

19. Judith Kas, Bram Bet & Daphne Truijens. Barriers and Best Practices for the Circular Economy. SMO Promovendi. Circular Minds 2017-2018.

20. Rabobank Nederland. ABN AMRO, ING and Rabobank launch finance guidelines for circular economy. Rabobank Nederland Press Releases. [Online] Jul. 9, 2018. [Cited: Aug. 25, 2019.] https://www.rabobank.com/en/press/search/2018/20180702-abn-amro-ing-and-rabobank-launch-finance-guidelines-for-circular-economy.html.

21. Erik Pauer*, Bernhard Wohner, Victoria Heinrich and Manfred Tacker.Assessing the Environmental Sustainability of Food Packaging: An Extended Life Cycle Assessment including Packaging-Related Food Losses and Waste and Circularity Assessment. Basel: MDPI AG, Basel, Switzerland, 11 2019, Sustainability, p. 925. Section of Packaging Technology and Resource Management, University of Applied Science, 1030 Vienna.

22. European Union. Closing the loop: Commission adopts ambitious new Circular Economy Package to boost competitiveness, create jobs and generate sustainable growth. Brussels: European Union, Dec. 2, 2015.

23. California Product Stewardship Counsel. California ERP Legislation. https://www.calpsc.org/.[Online] Aug. 13, 2019. [Cited: Aug. 13, 2019.] https://www.calpsc.org/legislation.

24. CalRecycle California Goverment. California Recylce Policy and Law. [Online] Jul. 19, 2019. [Cited: Aug. 13, 2019.] https://www.calrecycle.ca.gov/epr/policylaw.

25. OECD. OECD (2016), Extended Producer Responsibility: Updated Guidance for Efficient Waste Management, OECD Publishing, Paris. [Online] Sept. 16, 2016. [Cited: Aug. 13, 2019.] https://www.oecd-ilibrary.org/sites/9789264256385-4-en/index.html?itemId=/content/component/9789264256385-4-en.

26. PlasticsEurope Assn. of Plastics Manufacturers. Plastics the Facts 2017. European Assn. of Plastics Manufacturers, 2018.

27. Berenschot, Joost Krebbekx and Gijs Duivenvoorde - and Innovation, Siem Haffmans – Partners for. Roadmap towards increasing the sustainability of plastics packaging. NRK Verpakkingen, 2018. p. 74.

28. European Food Safety Authority. Plastics and Plastics Recycling. [Online] [Cited: Aug. 24, 2019.] https://www.efsa.europa.eu/en/topics/topic/plastics-and-plastic-recycling.

29. U.S. Food and Drug Administration. Recycled Plastics in Food Packaging. [Online] Mar. 21, 2018. [Cited: Aug. 24, 2019.] https://www.fda.gov/food/packaging-food-contact-substances-fcs/recycled-plastics-food-packaging.

30. OECD. Improving Markets for Recycled Plastics: Trends, Prospects and Policy Responses,. Paris : OECD, 2018.

31. Project, The Climate Reality, [prod.]. Ethane Cracker Plants What Are They. Washington D.C.: The Climate Reality Project, Oct. 23, 2018.

32. Senators Allen, Skinner, Stern and Wiener. SB-54 California Circular Economy and Plastics Pollution Reduction Act. [leginfo.legislature.ca.gov]. Sacramento, California, USA : California State Legislature, Aug. 14, 2019.

33. Reusables Organization About Page. Usereusables Organization. [Online] [Cited: Aug. 18, 2019.] http://usereusables.org/about-reusables.

34. Dutch Ministry of Infrastructure and the Environment and the Ministry of Economic Affairs. The Circular Economy. Den Haag: September 2016.

35. TNO. Holland Circular Hotspot Home Page. Holland Circular Hotspot. [Online] 2019. [Cited: Aug. 21, 2019.] https://hollandcircularhotspot.nl/en/.

36. Dutch Packaging Waste Fund Home Page. Afvalfondsverpakkingen.nl. [Online] 2019. https://afvalfondsverpakkingen.nl/en/packaging-waste-fund.

37. Policy Afvalfonds Verpakkingen (Packaging Waste Fund). Afvalfondsverpakkingen.nl. [Online] Dec. 20, 2018. [Cited: Aug. 21, 2019.] https://afvalfondsverpakkingen.nl/a/i/Beleid-Overeenkomsten/Policy-2019.pdf.

38. KIDV. Organizational Structure. KIDV Netherlands Institute for Sustainable Packaging. [Online] [Cited: Aug. 21, 2019.] https://www.kidv.nl/228/over-het-kidv.html?ch=EN#organizational-structure.

39. Netherlands Institute for Sustainable Packaging (KIDV). Brand owners combine forces to address challenges to make flexible packaging circular. Jul. 16, 2019. Press Release.

40. Centraal Bureau Levensmiddelenhandel (CBL). 20% minder verpakkingen in de supermarkt in 2025. CBL Laaste Nieuws . [Online] Feb. 15, 2019. [Cited: Aug. 25, 2019.] https://www.cbl.nl/consumenten-hebben-weer-vertrouwen-in-de-supermarkt-2/.

41. MOV Nederland. Future Proof Community. Future Proof Community. [Online] Aug. 24, 2019. [Cited: Aug. 24, 2019.] https://futureproof.community/.

____________________________________________________________________________________________

Find your success! Subscribe to free Packaging Digest enewsletters.

Find your success! Subscribe to free Packaging Digest enewsletters.

About the Author(s)

You May Also Like