Quality, then cost

December 21, 2015

The economy is straining packaging budgets, but packaging engineers report that maintaining quality is still more important than cost cutting.

Economic ups and downs are certainly driving change in the pharmaceutical and medical device packaging markets, perhaps accelerating trends that began long ago, such as downgauging and lightweighting. But given the heavily regulated industry and its conservative, quality-minded packaging professionals, change happens slowly. While such a pace often means that innovations take time to penetrate the industry, it also means that attempts to reduce operating costs typically do not happen quickly.

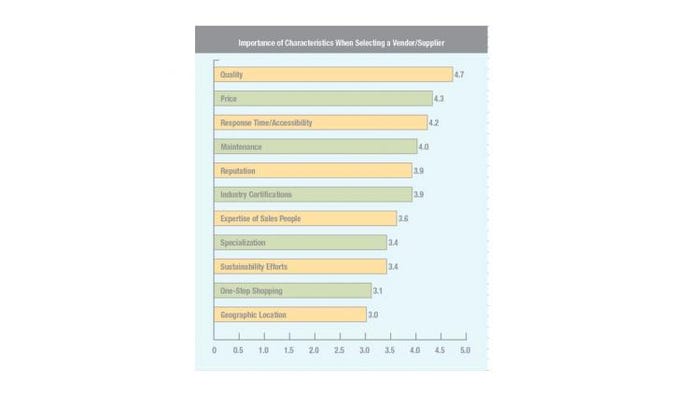

In fact, pharmaceutical and medical device packagers still put quality concerns ahead of economic, and for good reason, given the critical nature of their products. According to the results of a survey that Pharmaceutical & Medical Packaging News conducted earlier this year through Readex Research, quality edges out costs. Asked to rank the importance of certain characteristics when selecting a vendor/supplier on a scale from 1 to 5 with 5 representing “very important,” respondents ranked quality first at 4.7, with price ranked at 4.3.

Of course, given economic pressures, pharmaceutical and medical packaging professionals are looking at ways to boost or streamline productivity and consolidate expenses where they can. According to another PMP News survey, our annual salary survey, several respondents indicated significant involvement in automation and outsourcing, centralization, lean manufacturing, offshore component sourcing, and downsizing programs.

But if any packaging professionals have been tempted to skimp on quality, a number of very high-profile recalls and plant shutdowns in 2009–2010 may have given them just pause. After one of the most trusted drug manufacturers recalled millions of containers under long-respected brands owing to consumer complaints and negative inspection reports by FDA, the rest of the industry most likely took a second look at their own facilities and procedures to stave off any potential quality issues.

Despite cost cutting, the supplier base supporting pharmaceutical and medical device packaging continues to report high demand for materials and containers with demonstrated product safety. “Without a doubt, drug safety and efficacy are the primary drivers of pharmaceutical packaging,” notes Georgia Mohr, pharma segment director for Perfecseal. “Therefore, packaging technology is driven by a long list of drug safety and efficacy issues, which includes but is not limited to maintaining sterility and efficacy throughout shelf life, increasing drug compliance, and eliminating administration of the wrong drugs.”

There is hope that innovation exploration could pick up, as the drug industry is developing more convenient dosing means while also becoming increasingly influenced by biotechnology. “Pharmaceutical companies are introducing many ways of delivering drugs into the body more effectively including oral, inhalation, transdermal, injections, nasal, etc. In addition to drug safety and efficacy, the method of drug delivery dictates the packaging requirements to a great extent,” says Mohr.

Packagers may also be called upon to help address healthcare challenges such as medication errors and nonadherence with drug regimens. For instance, FDA held a public workshop on developing guidance on naming, labeling, and packaging practices to minimize medication errors. Mistakes related to packaging and labeling issues were discussed on the meeting’s first day, with all speakers acknowledging the significant size and scope of the problem. Non-adherence with drug regimens was also discussed, with one presenter calling it “the most common type of medication error studied in ambulatory self-care settings.”

The challenge for drug and medical device packagers will be finding ways to maintain (or step up) quality and to foster innovation in a not-so-rosy economy. Material and equipment providers are feeling the strain as the industry pushes them to provide more for less, but nimble suppliers are devising creative solutions.

INCREASED SCRUTINY

In May, Joshua Sharfstein, FDA’s principal deputy commissioner, outlined FDA’s quality expectations before the U.S. House of Representatives Committee on Oversight and Government Reform. Sharfstein was present to discuss FDA’s oversight of McNeil Consumer Healthcare LLC, which over the past year has recalled millions of OTC drug products because of quality concerns. “The cGMP regulations for drugs contain minimum requirements for the methods, facilities, and controls used in manufacturing, processing, and packing of a drug product. The regulations are intended to ensure purity, potency, and quality of drug products, and to prevent unsafe products from reaching consumers,” he testified. “A violation of cGMP does not necessarily mean that a product is hazardous to the public. It does indicate, however, a breakdown in a manufacturer’s quality system and is an indication that a company needs to take effective steps to fix the problem promptly.”

Sharfstein said that FDA is refining its approach to enforcing quality. “FDA is now looking at our process for clear expectations and standards with respect to other types of recalls, such as those undertaken by McNeil. We will continue to work with Congress to secure additional authorities that could assist us in assuring product quality and acting more quickly when product quality issues occur.”

Jean-Francois Leclair, director of marketing, Amcor Glass Tubing Americas, believes “FDA regulations and expectations are becoming more stringent to reflect the desire for flawless medical treatments.” In that context, he says, “we already see a very strong trend of increasing quality expectations and documented and controlled processes.”

Could FDA toughen up even more when it comes to ensuring drug and medical quality? When it comes to maintaining drug product temperatures, some suppliers are already sensing greater scrutiny. “There is increasing demand to be able to ship and store products that need to be kept at 20°C–25°C or 15°C–30°C,” says William Hingle, director of marketing, Cryopak (Edison, NJ). “This is being driven not only by new product development but also through increased regulatory scrutiny of such products. Many times the value of these products is significantly less than that of other temperature-controlled products, therefore the added packaging required to maintain these products adds stress into the supply chain. Suppliers such as Cryopak are developing new cost effective products to meet this challenge.”

Manufacturers are asking more detailed questions of suppliers, reports Tom Misik of Belco Packaging Systems Inc. "There is an ongoing effort by manufacturers to assemble vendor documentation from even non device product suppliers, such as the heat sealing equipment we provide. Companies have always asked us for performance data on critical equipment processes, but the requirement to inspect internal documents is relatively new. Companies are drilling down and looking into vendor systems. These companies are developing approved supplier procedures and need such documentation to satisfy their internal auditors. In this business you have to demonstrate high confidence and competence. We welcome those inquiries.”

Material converters have seen changes in customer requests demonstrating a renewed focus on improving quality. “We see an increased amount of requests for documentation, LOAs, etc. even from long-term customers,” says Angela Roggenhofer, sales and marketing manager for Tekni-Plex. “Either induced by direct FDA requests or audits or rather as a preventive measure stirred up by issues at another company, many pharma companies are revisiting their procedures and have begun addressing issues that might have been slumbering for years, hoping to catch them before FDA does.”

Adds Justin Schroeder, director, marketing and business development, Anderson Packaging: “The past year has certainly opened some eyes in the industry on how cost cutting and losing the quality focus can negatively impact a firm. Whether [a manufacturer is] packaging internally or outsourcing work to a partner, a mishap caused by poor quality systems can have severe effects. It reinforces the notion that a firm needs to choose partners very carefully, and not simply on low cost. We have always strived to be on the leading edge of the industry from a quality and regulatory perspective. It certainly takes vigilance and an top-down focus on continuous improvement. We actively engage FDA and also benefit from regular auditing and dialogue with the 50+ pharmaceutical companies we serve.”

ASKING FOR HELP

The pressure on pharmaceutical and medical device packagers may be unprecedented. “There is no doubt in our minds that the industry is transforming,” says Leclair. “As the pharmaceutical companies are building their R&D strategies for the future, in many cases through M&A, there is a constant strive for production efficiency. In the past two years, the economy has put a lot of pressure on all businesses in almost every industry. It has become a necessity to evaluate and understand real costs and identify where value resides within everyone’s operations. For instance, we have seen several large pharmaceutical companies proceed with global tenders and eBids to enhance and rationalize their vendor base. With very large pieces of business at stake, these tenders have forced us to clearly define our offering and to make sure that we can position a sustainable and sound value proposition. This means revisiting our operations to identify potential cost savings, but also refining our products and service to improve the offering.”

In order to maintain expected quality levels while under economic strain, pharmaceutical and medical device manufacturers are asking their packaging materials and machines for assistance. “The economy has driven more customers to become more lean,” says Tim Saarinen, commercial director of Amcor Flexibles Specialty Performance. “Demand for cost-effective solutions by all customers coupled with more demand for generic products have continued to drive Amcor’s Continuous Improvement (CI) processes. Amcor continues to have both internal and external CI projects with customers and suppliers to improve overall efficiency and supply-chain excellence. Our production sites continue to strive for improvements in all areas of quality with a ‘zero defects’ mentality utilizing poke yoke and other CI methodologies, stringent change control processes to maintain product integrity, and insisting on the highest standards in the Quality Systems.”

Supplier investments in new facilities and machinery often result in improved efficiencies that could benefit manufacturers. “We have just finished a six-year retooling and modernization project in which we invested significant capital in the latest equipment throughout manufacturing,” says Ward Smith, director of marketing for Keystone Folding Box Co. “Our goal is to produce the highest-quality packaging at the fastest rates, and our investments will help us achieve manufacturing efficiencies. If suppliers don’t reinvest and moderize, they become a weak link in the supply chain.”

Purchasing machinery, however, may be a bit tougher for packagers to do when capital budgets are tight. “In tough economical times when our customers are closing sites and laying off people, the investments in equipment are scarce and have to go through an intense approval process,” reports Dirk Corsten, managing director of Uhlmann Packaging Systems LP.

Even contract packaging firms may be rethinking new equipment purchases. Richard Bahr, president of MGS Machine Corp., a provider of advanced secondary packaging systems, says that a few of the contract packagers he works with have gotten short-term contracts with their own drug company customers ranging from three to six months, and that simply may not be enough time to acquire new equipment. “They may not be able to buy and install capital equipment in that short of a time, and the payback time may not even be enough to justify the investment. The contractors may then just retool or rebuild existing equipment, or rely more on manual labor to complete the project.”

Corsten says that Uhlmann has worked closely with some of its customers “to find ways to maintain and upgrade their current equipment base, instead of purchasing new machines altogether. For example, in an attempt to utilize older Uhlmann blister machines, we’ve initiated our OEM-rebuild program. In this program, many machines have been upgraded and rebuilt to cope with the latest standards and requirements. Every machine is backed up by a full OEM warranty. The companies that went through this program realized a significant saving in the overall investment, and the equipment is as good as new.”

For new equipment purchases, Bahr says that drug companies more and more are asking vendors to participate in bidding processes. Part of that work often entails having machinery builders prepare potential floor plans and complete other engineering tasks, even before a contract is signed. “These companies often have reduced engineering staffs, so we are taking on more of that work.”

Such upfront effort can put machinery suppliers in an awkward position. To secure a contract or win a bid, these suppliers want to present their best solutions at the outset. But if such work is done before a contract is signed, there is the chance that the solution presented by one machinery provider could be shared and implemented with another. Time is also a factor. “If brought in early, we can help solve an engineering problem, but we take a risk that ideas could be taken elsewhere.” says Bahr. “But if we are drawn in at the 11th hour, it may be difficult to make stuff happen fast.”

When it comes to materials and containers, drug and medical device manufacturers are also asking vendors to guarantee continuity and consistency in supply. “Oversight from FDA is increasing,” says Teri Meadow of Oliver-Tolas. “Many of our customers are making investments in high-quality materials and reliable suppliers/partners to minimize the risk and cost and enhance patient health. At Oliver-Tolas, our quality mission and process extend beyond our company to our suppliers. We are partnering with suppliers who understand the quality requirements of the medical and pharmaceutical industries. We have also invested in unique capabilities, such as vision systems, as added assurance of our product quality.”

In addition, “more than ever before, customers are also looking at redundancy in production,” says Roggenhofer from Tekni-Plex. “The globalization trend is definitely here to stay, and with that, so is the need for suppliers that offer facilities that can make identical packaging materials in different locations and on different continents. Tekni-Plex has already addressed this need with converting plants in the United States, Argentina, and Belgium and is further expanding to offer manufacturing capabilities in Asia.”

Material converters have been diversifying in recent years, becoming more of solutions providers than strictly materials suppliers, while material suppliers have been getting out of the solutions business, observes Peter Schmitt, managing director of Montesino Associates. He says that converters have evolved into “material-neutral suppliers focused most on providing a solution rather than a single material.” Schmitt points to Rio Tinto’s sale of certain Alcan Packaging businesses to Amcor and Bemis, shifting its portfolio back to raw material mining and processing, and to the planned acquisition by Constantia Hueck of converter Tobepal.

Klöckner Pentaplast continues to diversify its material offerings, and the firm positions itself as an “enabler for pharmaceutical and medical device manufacturers presenting a product to the market,” explains Daniel Stagnaro, business manager of pharmaceutical films for the Americas. “With our modeling software BlisterPro, Klöckner Pentaplast offers material selection and blister and tooling design assistance.”

Roggenhofer says that “customers [are] responding very favorably to our “one-stop-shop” approach. Tekni-Plex’s ability to offer a full array of blister materials—from bottoms and lidding foils to custom-made structures—is welcomed by our customers. They see it as a reduction in the complexity that normally comes with managing the array of suppliers necessary to provide all of the materials needed by a pharmaceutical manufacturer.”

Working with a supplier that can provide multiple solutions along with supply-chain management could take days out of a program schedule and even reduce a manufacturer’s output of working capital, says Aileen Ruff, manager, product and market development, commercial packaging, for Catalent Pharma Solutions. “Companies can then refocus their energy on other projects. We find that our customers are being more strategic, thinking less about procurement, and more about supply-chain solutions. With expertise across the global Catalent network, we can offer integrated supply chain solutions that provide such cycle time and working capital benefits, while reducing the risk and complexity that results from relying on multiple suppliers.”

INNOVATIONS FOR A CHANGING INDUSTRY

As competition intensifies among pharmaceutical and medical device manufacturers, companies are responding not with new blockbusters, but often with line extensions tailored to special needs and markets. Such a shift means that manufacturers are frequently producing shorter runs and therefore need flexible equipment. “In September 2009, we launched the latest model of our ultra flexible and fast changeover blister machine and cartoner, the Blister Express Center 300 (BEC-300),” says Corsten of Uhlmann. “It produces 300 blisters and 150 cartons per minute and a 3-dimesional changeover is done in less than 20 minutes. Small, inexpensive, and flexible, the BEC 300 pays tribute to the fact that most pharmaceutical manufacturers are facing the challenge of smaller batch sizes and growing numbers of SKUs. The old recipe of faster and bigger is better, simply doesn’t work anymore. In the very short period of time since its launch, the BEC has seen tremendous success and continues to thrive in today’s marketplace.”

New drugs coming to market are often more complex, such as large-molecule formulations or cocktail combinations of multiple drugs, notes Stagnaro of Klöckner Pentaplast. “We are also seeing drugs with higher concentrations for once-daily dosing or compounds for slow controlled release,” he says. “As a result, these products often need combined protection against moisture and oxygen.” Klöckner Pentaplast has been responding to this trend by offering high-barrier Aclar laminations, EVOH coextrusions and laminations, and high-crystallinity PVdC coatings.

Adds Schroeder: “New products coming to market require special handling, particularly large molecule delivery. One area of need is support for cold-chain logistics. We have invested in significant expansions of our on-site cold storage, with some products even requiring cold rooms for the packaging operation. We have expanded to accommodate more than 800 pallet locations for on-site storage between 2–8°C, with additional storage capacity for products requiring storage down to –20°C. Every product has unique requirements for handling, so we have very sophisticated systems to track them through the process from initial receipt to final delivery.

“With a shift in delivery mechanisms, we have also expanded our capabilities for packaging parenterals including labeling of vials, syringes, transdermal patches, and eye care products,” continues Schroeder. “Traditionally, the pharmaceutical contract packaging market had been very focused on oral solids and powders. Now customers are coming to us asking for very complex kit assemblies. Recently, this has included assembly of injectible devices, which require very specialized equipment and inspections. These types of programs often require cold chain handling, complex multiple component systems, and are high value products that need special care to keep process loss to an absolute minimum. They really need a very competent and experienced packager to meet the stringent quality requirements.”

The rise of combination products is also driving change in medical device packaging. “Combination products or hybrid products, such as drug-eluting stents, prefilled syringes, or inhalers, along with kits containing both medical devices and pharmaceutical products, are all driving requests for moisture or oxygen barrier performance and temperatur control,” say Justin Glass, business manager, medical device films, Klöckner Pentaplast.

And while downgauging has for some time been a frequent route for taking cost out of packaging, medical device packagers are still pretty cautious about downgauging or material changes, notes Glass. “Of paramount concern is packaging and seal integrity,” he says. “We are working with new polymers offering better impact strength and the chance for a small amount of downgauging. For instance, there is no question that the new copolyester Tritan [from Eastman Chemical] improves impact strength and heat resistance. But we don’t see companies switching to this or other new materials just for the sake of changing. It is being looked at for new products.”

TACKLING HEALTHCARE CHALLENGES

As nonadherence with pharmaceutical regimens continues to threaten patient outcomes, packaging suppliers continue to develop packaging solutions.

“Patient nonadherence in terms of taking and refilling medication is a global concern,” says Ruff of Catalent Pharma Solutions. “It is estimated that half of the annual prescriptions dispensed in the United States are not taken as prescribed, and over 30% of prescriptions for chronic conditions are not refilled. Poor adherence leads to less than optimal treatment outcomes, which in turn leads to increases in illness, hospital admissions, mortality, and overall healthcare costs. These trends apply worldwide.”

Drug companies are looking for “creative packaging design, particularly around unit-dose child-resistant packaging,” says Schroeder of Anderson. “We are working to take the stigma out of child-resistant packaging by designing packages that are very intuitive and consumer friendly. We have developed several new F = 1 packages that are being very well received in the market. IntuiDoseM is a format that has received multiple awards recently. In addition to CIAB and IntuiDose, over the past 6 months we have developed F=1 offerings including IntuiPac, AssuraDose, and an exciting line of plastic packing formats called DuraPac. They are all developed to be consumer friendly, cost effective, and designed with sustainability in mind.”

Ruff says that Catalent is offering designs “to support patient initiation therapy, titration requirements, and alignment with formulation positioning and Pharmacy-Benefit Management requirements for 30-day supply. Compliance packaging solutions also benefit ongoing therapies for chronic disease states where a missed dose has significant impact. We are seeing demand for compliance packages for therapeutic areas such as epilepsy, hypertension, and weight-loss programs. Customers include small, mid-tier, and large pharma.”

Even tubes are being designed with compliance-enhancing features. “To emphasize our ongoing commitment to compliance, we also offer an airless tube solution with an exact dosing system for topical applications and we are building a new production line for small diameters fully qualified in clean room ISO 8,” reports Richard Misdom, sales manager for Neopac.

However, while “consumer-friendly compliance packaging remains a well-recognized platform, it continues to struggle with cost justification,” notes Walter Berghahn, vice president, packaging technology, AmerisourceBergen Packaging Group, and chairman of the Healthcare Compliance Packaging Council. “This is primarily due to the fact that package providers, quite correctly, are selling the concepts to the pharmaceutical manufacturers, yet the true beneficiaries from improved compliance are at the far end of the supply chain. Ultimately the patient is the beneficiary, but one step removed from this is the payer who can obtain economic benefit from improved compliance: healthier patients, improved outcomes, and decreased medical costs.”

The vehicles for providing the payer and health administration community with this economic benefit are beginning to evolve, Berghahn continues. “The most widely known would likely be Medication Therapy Management programs under Medicare Part D. Packaging has not gotten much of a play here primarily because patients needs are assessed one at a time and CFCP might not be seen as necessary for all individuals in MTM. A great strategy would be to package chronic meds for the three conditions (asthma, diabetes, and heart disease) most likely to show up in the majority of MTM patients. Packaged products for medications associated with these conditions would be a great add on to existing programs.” Other areas that could gain economic benefit from increased patient adherence are Medical Homes programs and Transitions of Care programs that provide increased compensation for caregivers or providers for improved patient outcomes, he adds.

Smith of Keystone Folding Box notes that the industry has been closely watching retailer programs involving repackaged generic drugs for low-cost prescription programs. “The industry has been measuring the impact of these programs,” he says. The influence of these programs on new drug packaging decisions remains to be seen, but Smith does see “a lot activity” testing product stability in blisters. “The wheels are in motion; many products in the development pipeline appear to be targeted for unit-dose packaging when launched,” he says.

At FDA’s workshop on developing guidance to reduce the likelihood of medical errors, Kellie Taylor, who serves as associate director for FDA’s Division of Medication Error Prevention and Analysis in the Office of Surveillance and Epidemiology, told the audience that “33 percent of medication error reports to the [Institute of Safe Medication Practices; ISMP] Medication Error Reporting Program may be attributed to packaging and labeling of drug products, including about 30 percent of all fatal errors.”

FDA currently does not have guidance for industry describing design aspects of carton labeling and container labels, but the agency “is hoping that the input for this meeting will be useful in developing our good naming, labeling, and packaging guidance,” Taylor said.

Some of the errors could be attributed to what Taylor described as “small font size and illegible information that makes it difficult to read. . . . When you have these factors inserted into a carton or container label . . . on a shelf in a pharmacy, you can see how having cluttered information, labels that look alike, [and] labels that are poorly differentiated from other drug products can lead to error.”

Suppliers offered solutions. “Actually, we participated in this FDA workshop,” says Gene Dul, president of Schreiner MediPharm LP. “We have been aware of the importance of clear drug labeling and identification for many years and have addressed this issue by developing sophisticated labeling solutions that help prevent medication errors. Easy and fast drug administration combined with patient safety is one of the key objectives when developing our labels.”

For instance, the company has developed Pharma-Comb labels with one or several detachable parts that can help clearly identify the drug, all the way from dispensing to patient administration. A recent development is e.g. our Pharma-Comb SL label with self-lifting parts for multi-dose medications. Due to its smart construction, the detachable parts automatically rise after opening the outer label and can be easily and quickly applied to filled disposable syringes after drawing a dose from the vial. The peel-off parts contain all crucial information (dose, date/time of administration, patient’s name, initials of doctor or nurse) and can even be printed with a bar code. Thus efficient and safe drug administration can be ensured.

Peel-off labels are a valuable asset in ensuring patient safety and ultimately can help to avoid medication errors. They also offer additional advantages like optimization of processes in healthcare practice and a means to differentiate the pharma manufacturer’s brand from competitive products. The European market has always been very receptive for these kind of solutions and we feel that the U.S. market shows a growing awareness of these issues as well. The FDA workshop that has just taken place is certainly a good step in the right direction.”

FDA even discussed ways to increase the user-friendliness of packaging and labeling, and packaging suppliers continue to focus on such endeavors, too. “We’ve launched quite a few products this year that we feel really meet industry needs including our senior friendly, tailor made OTC tube with senior friendly thread and cap and our new and improved Twist’n’Use single dose system with optional child resistant cap – the smallest, certified child-resistant tube cap in the industry,” says Misdom for Neopac.

Packaging is also advancing to include integrated electronics, notes Berghahn. “Not simply RFID, but more-intelligent electronics can be used in concert with devices such as cell phones and custom-made items to enhance the compliance features of packaging and provide live interaction with patients. It raises the bar on the concept of aiding compliance and stays true to the HCPC message that patient adherence and outcomes can be improved through packaging. These electronics provide not only the opportunity to communicate with the patient but also to report to the caregiver, creating the opportunity for real time intervention instead of reacting after the fact which is currently the norm for our healthcare system. We only fix problems after they have occurred.

“It is a quite exciting time for the packaging community,” concludes Berghahn. “The opportunity to contribute to the solution of improved healthcare is quite real and evolving as we watch.”

Results from a 2010 subscriber survey by Readex Research for Pharmaceutical & Medical Packaging News. Respondents were asked to rank the above-listed characteristics when selecting a vendor. A score of 1 represents “not at all important,” while a 5 represents “very important.”

Also see sidebar: Join USP to tackle supply chain threats, extractables and leachables

About the Author(s)

You May Also Like