You're seeing success and progress in the supply chain, but there's still some work to be done, UPS survey finds

December 15, 2015

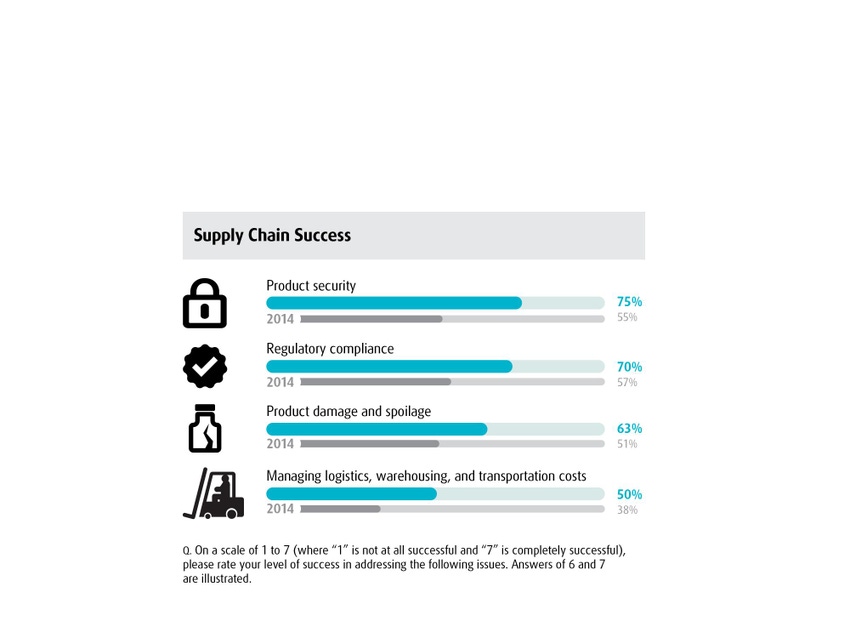

Healthcare product manufacturers are mastering some aspects of the global supply chain, but challenges remain. According to the 8th UPS Pain in the (Supply) Chain survey, respondents report success in addressing product security and regulatory compliance as well as progress in handling product spoilage and damage.

While there is still work to be done in these areas, respondents report their biggest challenges involve managing costs and contingency planning.

Of the 421 interviews conducted of healthcare logistics executives in 16 countries, 75% of respondents report success addressing product security, compared with 55% in 2014. And 70% of respondents report success in addressing regulatory compliance versus 57% in 2014.

“Success levels are pretty high in terms of regulations — firms have turned the corner on DSCSA [Drug Supply Chain Security Act], for instance,” explains Robin Hooker, director of healthcare marketing for UPS. Now “there is an increased focus on cost improvement, driven in part by the Affordable Care Act, but also by rapid business growth. Supply chains need to be flexible and innovative to address new demands and scale rather quickly. CEOs, however, are looking for cost reductions, so supply chain logistics professionals will be required to do more with less.”

Hooker says he was a little surprised to see in the survey that cost concerns weren’t more related to the costs of regulatory compliance and IT investments. “But it’s related to rapid business growth--the fact that the top cost driver is attributed to growth is actually pretty good news,” he says,” he says.

Given the variety and complexity of regulations around the world, however, compliance is still a challenge, perhaps just not as much as in previous years. Regarding last year’s survey,PMP News wrote: "Regulatory compliance is clearly the largest issue, both in North America and around the world, and it has been the top concern since 2011 when the survey was first fielded globally. In this year’s [2014’s] survey, 60% of respondents from around the world expressed concern with regulatory compliance.”

Pictured above: Robin Hooker, director of healthcare marketing for UPS

Companies do “still face challenges as they expand internationally,” Hooker notes. “The myriad regulatory factors in multiple countries are the biggest challenge.” One solution would be globally harmonized Good Distribution Practices, he says, so he encourages healthcare companies to advocate for them and “achieve a critical mass of industry leadership.”

Given cost concerns, however, companies “are seeking asset-light approaches” to managing compliance and global supply chains, he adds. Among the successful strategies that survey respondents shared, “without a doubt, there’s the notion that collaboration with logistics and distribution partners is a key factor,” he says.

The uptick in mergers and acquisitions in 2015 may also be driving concerns about cost. “It’s been a banner year for healthcare M&A,” says Hooker. “With it, supply chains are dovetailing. And there’s not a lot of budget for building warehouses, etc. At strategic planning tables, teams are looking for experts to devise distribution strategies that do not involve brick and mortar solutions, but instead virtual models.”

Maintaining product quality throughout the supply chain remains a top priority, too. The good news is that “technologies for monitoring shock, vibration, location, and temperature are becoming more affordable and more robust. And future technologies will allow more powerful monitoring solutions,” says Hooker. “Companies are looking for quality approaches for sensitive products, such as robust transportation providers that have such capabilities.”

Companies have also been investing in IT infrastructure to achieve more inventory visibility and control, Hooker says, but they are still looking for more support and expertise. “They are looking for solutions to mitigate damage and spoilage,” he says. “These include monitoring and intervention services, such as UPS Proactive Response.”

Support may also include financial and risk protection, he adds. “Not just for loss, but also for intervention and for expediting packages without additional expense,” says Hooker.

The survey results show that contingency planning still is a sticking point. “Firms tend to gravitate toward mitigating the high-probability, low-impact events,” but go behind the data of disruptive events, “the low-probability, high-impact events,” he says. “The fact that you cannot plan for everything doesn’t mean that companies should not make this a priority.”

As a model of successful planning, Hooker points to one of UPS’s medical device customers impacted by the tsunami and Fukushima Daiichi nuclear power plant melt down caused by Japan’s Tōhoku. “The company practices contingency planning and had already established linkages with the government in Japan and with supply chain partners so that the company could continue to distribute and respond with a degree of agility. Product moved relatively smoothly, which was a benefit to patients and to its business.”

Risks, costs pressures, and urgent market demands will only continue to increase in the coming years, so healthcare companies need to prepare. “Chronic disease will drive a lot of demands on the supply chain, yet companies will still face cost pressure,” says Hooker. “The supply chain will need to be efficient with new solutions and address risk.”

Hooker says UPS is “taking pages from the playbooks of other industries, such as the high-tech and retail sectors, to gain optimization and cost efficiency in the healthcare supply chain. Some of these learnings are already coming out of the retailization of healthcare and the infusion of talent from outside healthcare.”

UPS’s survey found that more than half of the executives who reported success in addressing regulatory compliance and product security reported that “they leveraged logistics and distribution partnerships and supply chain optimization analysis to drive their accomplishments.” Strategies for product security included investing in IT (bar coding, serialization, etc.; 67%); cooperation with law enforcement (41%); and visible authentication (visible holographs, security inks, etc.; 38%).

And those who reported success in managing costs reported relying on logistics and distribution partnerships (57%), leveraging a supply chain optimization analysis (55%), pursuing vested logistics and distribution partnerships (52%), and investing in IT (51%). In addition, the top strategy for addressing product damage and spoilage was partnering with a higher-quality carrier (74%).

Hooker’s forward-looking perspective is that thriving supply chains of the future will have invested heavily in updating IT infrastructure not only to address regulatory items like the DSCSA but also improve visibility and inventory management. “Compliance to DSCSA, other regulatory compliance activities can have business value for inventory management and efficiency if firms plan investments with compliance and optimization benefits in mind. In addition, successful firms will have combined logistics optimization analysis with business continuity and contingency planning—leveraging organizational thirst for efficiencies with the ‘medicine’ of risk mitigation and supply chain resiliency,” he says.

TNS conducted the Pain in the Chain survey on behalf of UPS between April and June 2015, interviewing a total of 421 healthcare logistics executives in 16 countries. The survey also includes an overview of the threats and opportunities facing the North American healthcare industry, ranging from opportunities such as technology advancements to threats such as competition and declining reimbursements.

To view the survey results, click here.

*******************************************

For packaging ideas, visit WestPack (Feb. 9-11; Anaheim, CA), where you can explore options and services and identify new, more cost-effective products and processes to help accelerate your packaging projects.

About the Author(s)

You May Also Like